GF Data Report: Valuations Holding Firm, Despite Lighter Deal Flow in H1 2025

A sneak-peek into GF Data's latest M&A report, available exclusively to subscribers

GF Data, an ACG company, has released its latest M&A Report, covering private equity-sponsored transactions completed through June 30, 2025. These reports are sent exclusively to GF Data subscribers.

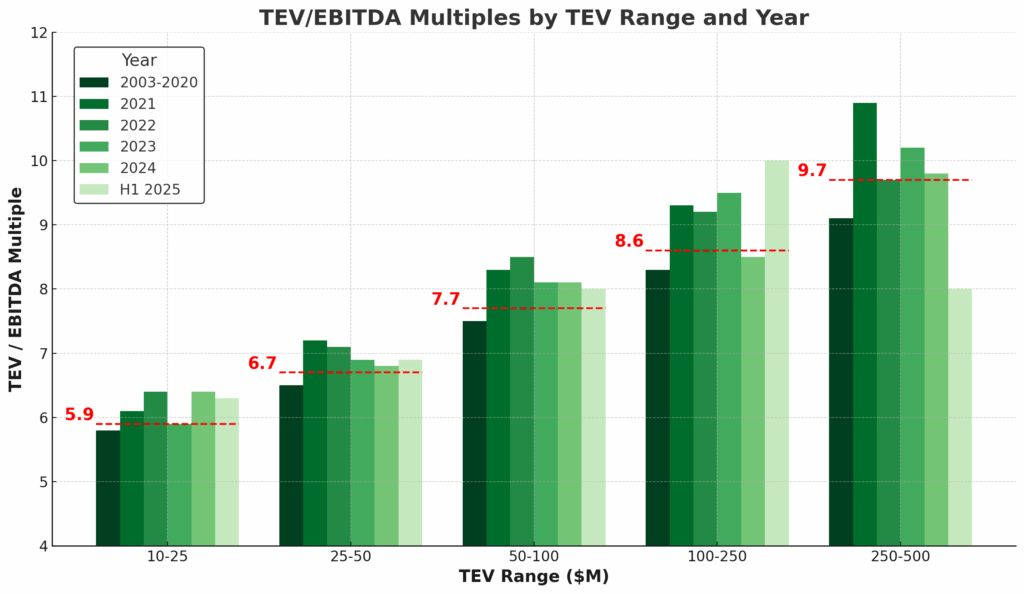

Through the first half of this year, average multiples held steady at 7.2x, unchanged from both 2023 and 2024. That consistency is notable given the roughly 30% drop in deal volume compared to 2024, as buyers continue to navigate rate uncertainty, macro headwinds, and a selective market environment. Even with fewer deals trading, valuations have remained stable, especially for quality assets at scale.

Chart 1 from the Q2 M&A Report (below) presents total enterprise value (TEV)/EBITDA multiples by deal size, with H1 2025 activity layered into a long-term view.

Additional highlights from the Q2 M&A report include:

-

-

- Sub-$25 million TEV tiers averaged 6.3x and 6.9x

- $100-250 million range led the market at 10.0x, the highest level since early 2022

- $250 million-500 million deals declined to 8.0x, though that figure is based on a limited sample size

-

The premium for scale continues to hold, and pricing has proven resilient through the first six months of 2025.

Want to explore the data further or benchmark your next transaction? Subscribe to GF Data to gain access to the full platform, including valuation metrics, leverage trends, key deal terms, and more.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit acg.org.