Signs of Life: PE Deal Activity Slowly Rebounds

Private equity deal activity is slowly rebounding, but buyers and sellers must get creative on deal terms for transactions to work

So far, 2023 has not been M&A’s year. High interest rates, inflation, recession risk and a difficult borrowing environment are all keeping deal flow at a near standstill. Buyers and sellers both say they want more certainty and, ideally, less-expensive capital before pursuing new exits and deals.

Whether either of those things materialize is an open question.

The pressure, however, may be more acute for private equity fund managers that have started to hear from LPs about the lack of distributions and limited new deals from funds currently in their investment period.

This section of the report originally appeared in the Fall 2023 edition of Middle Market DealMaker.

Illustration by Eva Vázquez.

If current conditions persist, general partners may have to fall back on the tips and tricks of private equity veterans who managed to close deals in the 1980s and ’90s, when interest rates were much higher than they are today.

Still, sources Middle Market DealMaker spoke to for this story expressed cautious optimism. Most noted a slight uptick in interest from both buyers and sellers toward the end of May as markets gained more clarity, thanks to the federal debt ceiling agreement and fresh jobs numbers showing a strong labor market.

Clouds Parting

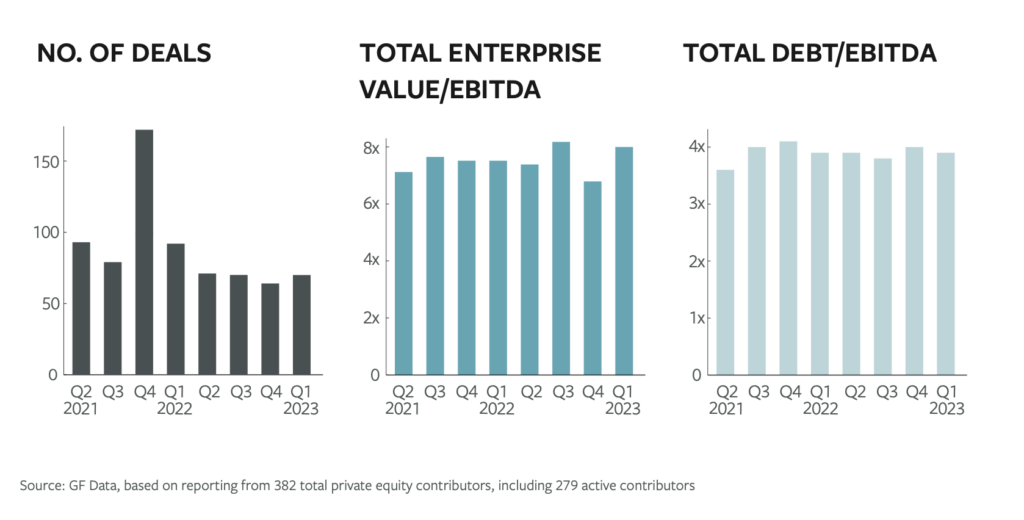

Sources’ cautious optimism was reflected in recent mergers and acquisitions data. Q1 M&A figures from GF Data, an ACG company that tracks private M&A transactions, shows some slightly positive indicators.

GF Data reports on deals with a total enterprise value (TEV) of $10 million-$500 million and TEV/ trailing 12 months adjusted EBITDA of 3x-18x. Its private equity contributors reported 70 transactions that met those criteria in the first quarter. That deal volume is slightly above Q4 of 2022, which had 64 deals, suggesting deals are getting done, even if they require a bit more patience and creativity. The deal count is on par with Q3’s 70 deals and down from 92 deals in Q1 2022.

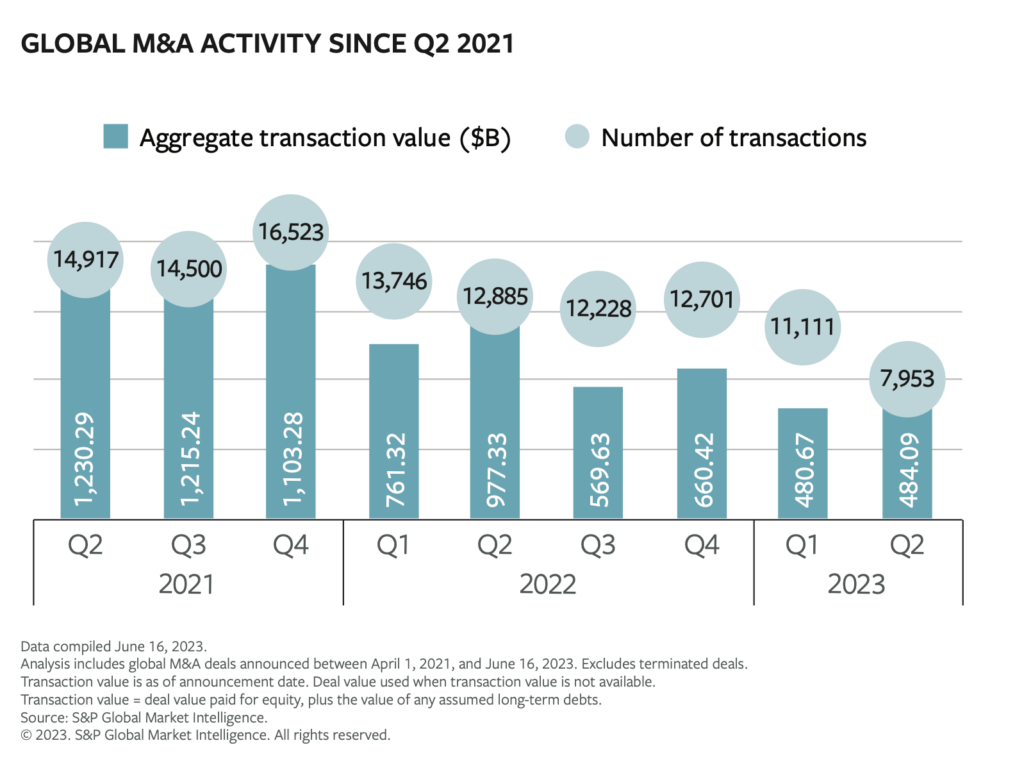

Data from S&P Global, which tracks a broader swath of deals, shows a steady decline in global deal count, with about 8,000 deals being completed through most of the second quarter (through June 16), compared to 11,000 in Q1 and 13,000 in Q2 last year, while deal value has fluctuated (see chart). Kenneth Wasik, managing director and leader of the consumer and retail practice at investment bank Capstone Partners, says a change in the dynamics between buyers and sellers may be impacting the pace of transactions this year. “We’ve seen a bit of a shift from, say, the fourth quarter of 2021, when there were a lot of buyers and no sellers. Now we’re seeing more sellers and fewer buyers,” he says.

Related content: GF Data Report: The Cost of Capital Hits Hard in Q1

Matthew Carlos, principal at Florida-based middle-market private equity firm New Water Capital, is seeing this trend specifically within family-and founder-owned businesses. “These are folks who want to sell based more on life decisions,” he explains. “There is a group of people out there who are getting older or who made it through the past handful of years, and they are ready to punch out their ticket and go home. If someone can get several million dollars, that’s still a lot of money even if it’s a challenging market environment.”

Story continues below.

GPs may be feeling the pressure, too, given the limits of investment timelines and fund life cycles. “There is still an ocean of capital out there that needs to be deployed, and investors are still looking for yield, so we may start seeing some pressure to transact,” says Brendan Burke, managing director and head of sponsor coverage at Capstone Partners.

Sources agree that for buyers, the issue right now is finding the right comfort level.

Michael Ewald, partner at Bain Capital Credit, says he’s hearing from would-be buyers that the potential for a recession still looms large, despite the agreement to suspend the U.S. debt ceiling and a slower pace of interest rate increases. “I don’t think it’s a question of buyers not wanting to do deals, but there is this issue out there where, if we do go into a recession, no one wants to have overpaid in an environment that’s already more expensive because of where rates are at,” he says.

If we do go into a recession, no one wants to have overpaid in an environment that’s already more expensive because of where rates are at.

Michael Ewald

Bain Capital Credit

Recession risk means that most of the deal activity so far this year is concentrated in so-called “recession-protected” industries like healthcare or business services, where demand for services is likely to persist even in an economic downturn. Capstone is also seeing interest in food companies and some categories of niche and specialty manufacturing.

Capstone’s Wasik adds that when buyers are pursuing deals, they are “focused on add-ons or core specialties in addition to recession-protected companies. … Given where the leverage market is at, smaller deals are easier to get done.”

Striking the Right Balance

Even if markets get more clarity on the macroeconomic picture and deal activity picks up, those transactions may look considerably different in structure from deals signed just a few years ago. Debt is hard to come by right now and, even if it becomes easier to access, interest rates have influenced how much leverage companies can afford.

“Rising rates suck a lot of free cash flow out of companies. It’s almost like a tax,” Bain’s Ewald says. “You could have a company that’s doing well, but with rates where they are, it changes the math on leverage, and we’re seeing terms change in response.”

Sources say GPs are putting more equity into deals than they might have otherwise, with the hope of refinancing in the future. Structuring a transaction has also become more cumbersome. More proof of performance is required, and earnout and performance timelines are lengthening. New Water’s Carlos says they’ve looked into “performance payments, or seller financing as part of our equation to get deals done. We’re seeing more willingness from the seller side and investment bankers to think through creative ways to get these deals done.”

The focus on terms could increase over the next several months—especially if buyers are worried about overpaying in this environment. Trends in valuations could also be adding some pressure. A recent GF Data report shows that valuations are starting to tick up after coming down in the back half of last year.

Valuations on deals completed in the first quarter of 2023 averaged 8.0x TTM adjusted EBITDA, rebounding from the 6.9x average recorded in Q4 2022 and in line with the 8.2x average set in the third quarter, according to GF Data’s first quarter report. On an annualized basis, 2023 got off to an aggressive start in terms of valuations, with the 8.0x average significantly above the 7.6x average recorded for all of 2022.

Related content: DealMAX Panelists Discuss Alternative Financing Solutions

According to S&P Global, deal value was about flat between the first and second quarter, while representing a smaller number of deals, suggesting that sellers are still putting premium assets up for sale. Sources say that although the pace of transactions has slowed broadly, the highest quality deals across industries are still commanding a lot of interest and a premium price.

The potential for new activity because of greater market certainty could also have an impact. “People are waiting on the sidelines, but they can’t wait forever,” says Scott Green, managing director at middle-market private debt firm Antares Capital. “We are starting to see a slow pickup of activity that is giving us some hope for later in the year.” He adds that as buyers and sellers get more comfortable with the overall environment, that could lead to more deals getting done.

People are waiting on the sidelines, but they can’t wait forever. We are starting to see a slow pickup of activity that is giving us some hope for later in the year.

Scott Green

Antares Capital

The Waiting Room

Sitting on the sidelines could have an impact of its own. Jeffrey Stevenson, managing partner at private credit firm VSS Capital, says that he’s working with companies that are postponing a sale and opting for other forms of financing while they wait things out.

“We are seeing more companies choose not to go to market in this environment and instead pursue structured capital solutions. We think this could be a longer-term trend—traditional debt financing is likely to remain tight for at least the next 12-18 months,” he says. “Companies prefer structured capital because they don’t have to give up control.”

Structured capital and preferred equity can be used to support business operations and bolt-on-type expansion plans in lieu of a traditional buyout. However, Capstone’s Burke notes there’s a bit of a balancing act with interim strategies, too.

“If everyone waits and then comes into the market based on the same set of signals, it’s going to be that much harder for your deal to stand out,” he says. “That can impact purchase price, deal economics.”

New Water’s Carlos agrees. “You have to weigh the pros and cons. If you can get more visibility on a high performing asset now, even in a skittish environment, there still might be an advantage over trying to stand out when everyone is suddenly in market.”

Carlos adds that sellers might be surprised if they do want to sell right now. “At the end of the day, private equity GPs are capital allocators. We have a shot clock on deployment. So if there is a premium asset out there that is within your mandate, you have to at least look at it because it’s within your mandate.”

Bailey McCann is a business writer and author based in New York.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.