Adieu, Add-ons!

Platforms are a growing focus for sponsors in 2025

Last year will likely go down as the peak for add-on investments by middle-market private equity groups.

Spurred by challenged debt markets, seller pricing expectations and lower average valuations, private equity firms in 2024 shopped down market to beef up existing platforms, leading to a record year for add-on investing.

But that all looks to be over now.

While add-on investment activity peaked in the middle of 2024, reaching 44% of deal activity tracked by GF Data (compared to a 2023 average of 35%), the fourth quarter brought a resurgence in platform investing, bringing the year-end tally for add-on investments to 40%, according to our analysis.

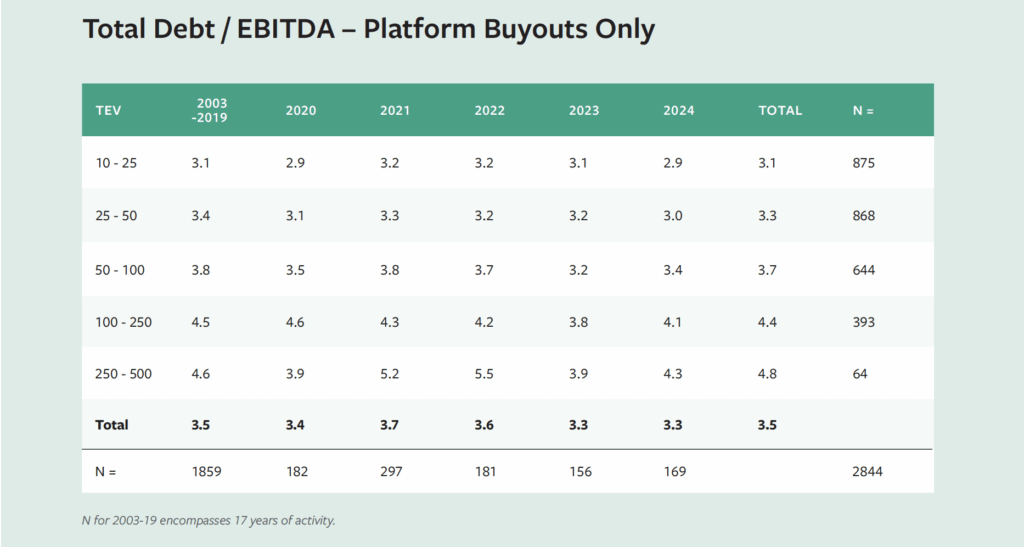

The increase in add-on activity began in 2022, following a multi-year low the prior year (when add-ons accounted for just 26% of deals tracked by GF Data). Debt—both the availability, or lack thereof, and pricing—played a pivotal role in the shift away from platform investing. In 2021, average total debt coverage stood at 3.6x trailing 12-month (TTM) EBITDA but fell to an average of 3.3x TTM EBITDA for both 2023 and 2024 (two-tenths of a turn below the historical average of 3.5x).

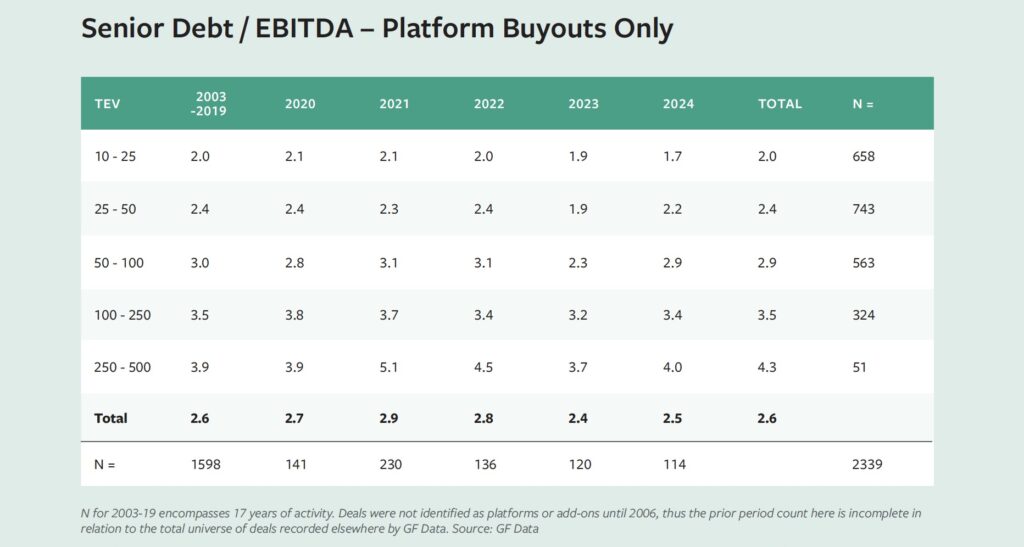

Senior debt coverage, meanwhile, fell from an average of 2.9x TTM EBITDA to a low of 2.4x TTM EBITDA in 2023. The failure of Silicon Valley Bank in March 2023 along with other institutions spooked the banking community and pulled most banks out of the leveraged lending market in the second half of that year.

The lack of supply from banks for senior debt—exacerbated by interest rate increases by the Federal Reserve to tamp down inflation— was addressed by increased use of non-banking sources and resulted in a massive increase in borrowing costs.

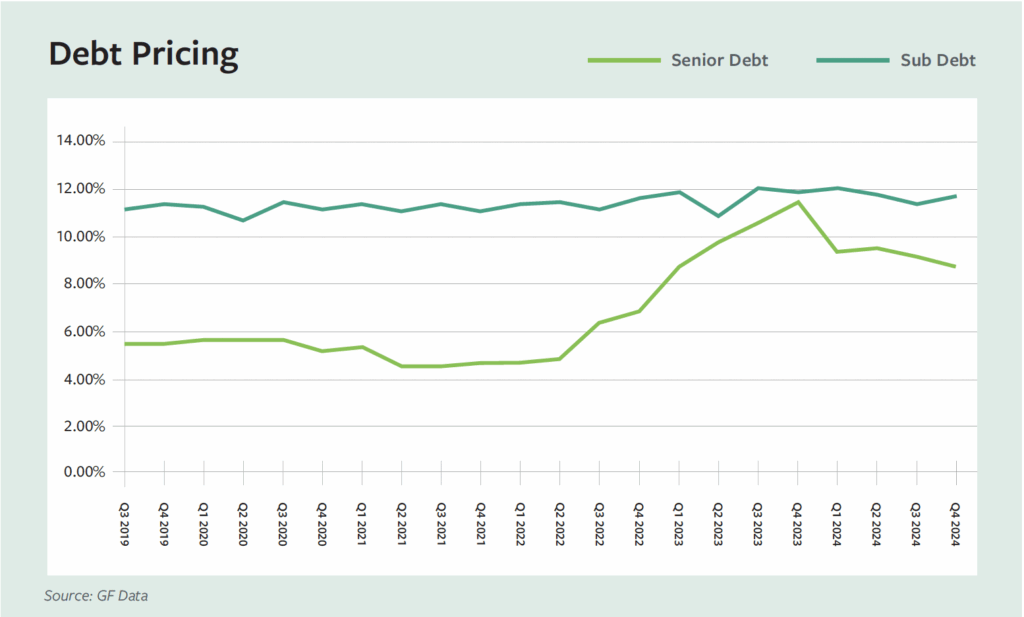

Pricing on senior debt (including both bank and non-bank financings) more than doubled, moving from an average of 4.8% in the second quarter of 2022 to an average of 11.5% in the fourth quarter of 2023, nearly converging with average subordinated debt coupons at the time. Clearly, from a credit perspective, it made a lot of sense for private equity to focus on add-on investments, which can be financed with existing debt facilities linked to the platforms acquiring them.

Valuations also played a significant role in pushing add-ons to the forefront last year in two ways. First, purchase price multiples averaged 7.5x in 2021 compared to 7.1x last year.

That means that sponsors of acquisitions from the earlier era had ground to make up on their investment thesis, and scaling through an add-on acquisition spree was a good way to do it. Second, the $10 million to $25 million total enterprise value (TEV) tier, where the majority of add-on activity tracked by GF Data occurs, offers preferential pricing compared to larger deals. Valuations for deals in this tier averaged 6.4x TTM EBITDA compared to an average of 8.5x TTM EBITDA for deals valued between $50 million and $100 million—a difference of more than two turns of EBITDA.

So why have we seen the peak?

Debt availability began to improve in the second half of 2024, and banks are now aggressively courting buyout financings. We predict this will lead to improving debt coverage in the coming year. (It’s already started, as average senior debt contribution across all deals tracked by GF Data improved by 2.6 percentage points, while average equity contribution declined by 1.5 percentage points.) Senior debt pricing also continued to decline, falling to an average of 8.7% for the fourth quarter, which makes

pursuing larger platform deals a lot more cost effective than a year prior.

But perhaps most importantly, the reduced level of platform deal activity has created a backlog of both private equity firm portfolio companies that need a realization event as well as high-performing family-owned businesses that have been sitting out the market waiting for improving conditions. We predict this backlog will enter the market in the coming four quarters, leading to a significant resurgence in platform dealmaking.

Bob Dunn is GF Data’s managing director.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.