Stable M&A Activity Predicted Through Year-End: ACG Survey

ACG’s Q3 Market Pulse Survey reveals tempered confidence for dealmaking over the next six months

Middle-market M&A professionals expressed moderate confidence in the state of the market at the start of Q3, predicting slight improvements to M&A volume, financing and valuations, even as they expressed caution about the risks of an economic downturn and political instability.

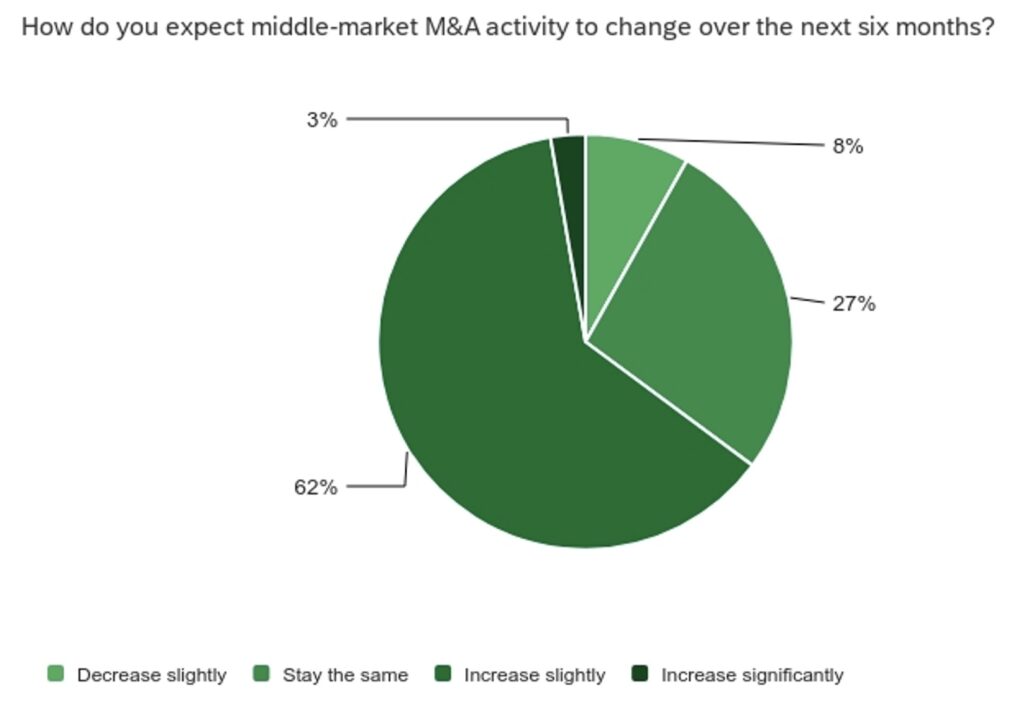

A recent survey conducted by ACG and GF Data, an ACG company, revealed generally positive expectations for midmarket M&A over the next six months. Sixty-two percent of respondents predicted activity will increase slightly, while 27% said they expect activity to stay the same. Only 8% anticipated a slight decrease.

The outlook for valuations over the next two quarters was also cautiously optimistic, with 49% of respondents predicting valuations will remain steady and 32% anticipating a slight increase in pricing.

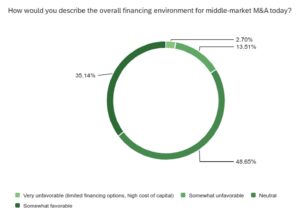

A contributing factor to dealmaking ease and valuations is the overall financing market, which 84% of respondents described as either neutral or somewhat favorable at the start of Q3. However, none described it as highly favorable, characterized by plentiful financing options and low cost of capital.

M&A Drivers and Industries of Interest

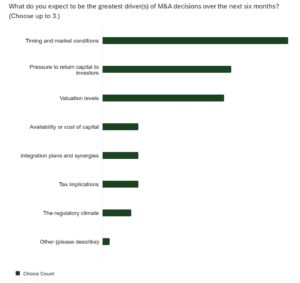

Survey respondents shared the top three factors they expect to drive M&A decisions over the next six months. Timing and market conditions was the top response (70%), followed by pressure to return capital to investors (49%) and valuation levels (46%).

“I think a key driver of deals is that many business owners are getting older and are ready to retire, so they will be either selling their business or transitioning the business to younger family members,” one respondent noted.

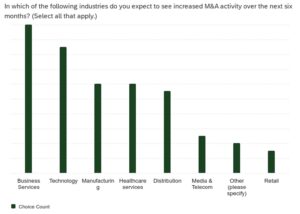

Business services and technology topped the list of industries where respondents expect to see increased M&A activity over the next six months, followed by manufacturing and healthcare.

More than half of respondents pointed to retail as an industry where they expect activity to decrease over the next two quarters.

Most survey respondents (63%) said they don’t expect to see much change to deal timelines over the next six months.

M&A Risks

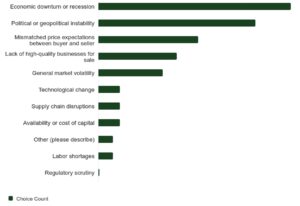

Asked about the three greatest risks to middle-market M&A activity over the next six months, 79% of respondents cited an economic downturn or recession. Political or geopolitical instability was the second most-cited risk (23%), while mismatched price expectations between buyers and sellers was a distant third (15%).

Several respondents added commentary about risks in their respective industries.

“In the healthcare industry, the seeming continued federal scrutiny of PE involvement in healthcare, along with the increasing state-level scrutiny and required state pre-transaction notices, seems to be lessening the number of PE-backed healthcare transactions, particularly in the practice management roll-up arena,” noted one respondent.

“Tariffs and wars are a major concern for the automotive parts industry, where we focus,” another wrote.

Several survey respondents commented about how general economic uncertainty and the lack of clarity around tariffs and other government policies are a drag on dealmaking. “I believe once we get more clarity on these items, M&A activity will increase as buyers become less hesitant, and that clarity will also help to better align buyer and seller value expectations,” a commenter noted.

The Q3 Market Pulse Survey from ACG and GF Data polled members of the middle-market M&A community between July 7 and July 20. Hosted on middlemarketgrowth.org and promoted via email and ACG’s social media accounts, the survey drew 37 responses from a broad cross-section of private capital investors, lenders, investment bankers, strategic acquirers and advisory firms.

The next quarterly Market Pulse Survey will open in early October.

Katie Maloney is ACG’s vice president of Communications & Content.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.