Surviving the Tariff Era: How AI Transforms Tariff Risk into Operational Advantage

Teragonia's Thomas Thayyil Thomas considers how tariff risk impacts the middle market

In an era of escalating tariffs, the survival and success of middle-market companies hinge on their ability to transform volatility into strategic advantage. For private equity-backed firms with high leverage and lean teams, navigating these shocks requires smart alignment of sales, procurement, pricing and inventory, powered by advanced analytics.

At the macroeconomic level, risks are increasing. Goldman Sachs forecasts U.S. GDP growth to slow to 0.5% in Q4 2025, with a 45% chance of recession due to tariff volatility, while J.P. Morgan warns sustained tariffs could shave up to 1% off global GDP.

By distorting both demand and supply dynamics, tariffs trigger shifts in consumer behavior while destabilizing supply chain operations. As middle-market companies navigate these impacts, they must rethink pricing, forecasting and liquidity planning. AI-powered decision intelligence is becoming a critical lever for executives to preserve margin, protect cash flow and sustain growth amid economic uncertainty.

Understanding Complex Consumer Behavioral Shifts to Master Demand Dynamics

On the demand side, tariffs trigger two simultaneous economic responses:

-

- Income effect: As prices rise without corresponding wage growth, real purchasing power declines, leading to reduced spending of normal goods. Firms must assess the elasticity of their products to changes in income—a key indicator of shifts in consumer demand.

- Substitution effect: Consumers seek cheaper alternatives to tariff-affected goods. These may include domestic products, deferred purchases, or “dematerialization,” such as subscriptions and service-based solutions, in lieu of product ownership. While some firms are able to capitalize on these substitution patterns, most experience volatile, nonlinear demand patterns that traditional forecasting methods struggle to capture.

Tariff-driven demand fluctuations create cascading disruptions across the supply chain. Procurement strategies become reactive as costs climb and delivery times stretch. Inventory management becomes a high-stakes balancing act, where overstocking products with declining demand erodes liquidity and understocking emerging substitutes sacrifices revenue.

Traditional forecasting models often fall short, leaving operations vulnerable to persistent mismatches between supply and demand. To protect margins, middle-market firms must assess their ability to pass through costs without compromising volume—recognizing that inelastic products may tolerate price increases, while others demand strategic trade-offs.

Strategic Alignment Under Tariff Pressure: Operational and Financial Considerations

Tariff volatility is a direct stress test of Sales and Operations Planning (S&OP), supply chain resilience and strategic pricing. Firms must coordinate across multiple business functions to navigate this challenge successfully.

Finance leaders face significant forecasting challenges as tariffs create divergent price environments across product categories. They must manage potential revenue declines, while expanding working capital requirements to exploit strategic pre-tariff inventory builds.

Deviations between forecasts and outcomes raise debt covenant compliance risk and can precipitate liquidity crises, especially for highly leveraged firms. This complexity is further magnified by deteriorating business sentiment, evidenced by a sharp 1.3% drop in U.S. core capital goods orders in April 2025, signaling delayed capital investments due to growing economic uncertainty. J.P. Morgan projects core PCE inflation could even reach up to 3.1% in 2025, creating a moving target for financial planning.

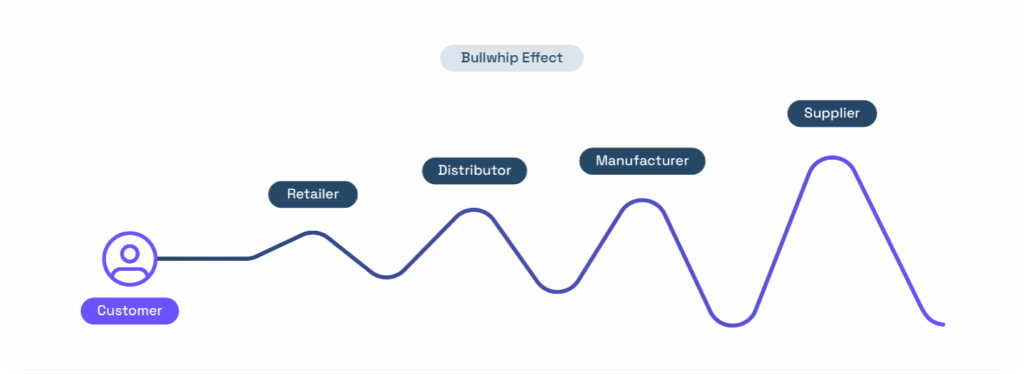

Operations and procurement teams confront disruptions in inventory management and supply chain planning. Tariffs invalidate conventional Economic Order Quantity (EOQ) models. Companies must consider expediting procurement processes, alternative suppliers, and preserving key supplier relationships—all while managing cash flow pressures and avoiding the “bullwhip effect,” where over-ordering in the face of uncertainty confuses true demand signals. Leaders must tailor procurement and pricing strategies by product type, balancing cost absorption with pricing power to protect margins without eroding volume.

Revenue and pricing teams must integrate elasticity analysis with strategic customer segmentation to navigate tariff-driven pricing pressures. Elasticity varies sharply across income levels and customer types for a singular product. Necessity-driven or high-income segments may be price inelastic, while others are highly price-sensitive. During tariff periods, this divergence intensifies, requiring pricing strategies tailored to customer value for effective differentiation.

Navigating these challenges in tariff periods demands tight cross-functional collaboration. Traditional planning is too slow; strategic finance must be agile, predictive and responsive. CXOs must adopt a data-centric approach to liquidity forecasting to preserve lender confidence and protect critical financial ratios.

AI-Driven Resilience: Advanced Machine Learning Applications

In this environment of heightened uncertainty, advanced machine learning techniques provide concrete tools for navigating tariff-induced volatility across three critical domains.

1. Demand Elasticity Estimation requires sophisticated quantitative models that go beyond traditional regression-based models, which often fall short when historical price-demand relationships break down. Companies should consider:

-

- Bayesian time series models, which combine historical data with expert input for adaptive forecasts

- ARIMAX models, which integrate external drivers like macroeconomic trends and competitor pricing to sharpen predictions

- Ensemble learning approaches, which dynamically weigh multiple models based on recent performance to stay responsive to shifting market conditions

2. Sales Forecasting in volatile conditions demands AI predictive capabilities that can distinguish temporary noise from structural demand shifts—capabilities that can reduce forecasting errors by up to 50%. These tools include:

-

- Prophet models with built-in changepoints help account for tariff-driven disruptions

- Temporal Fusion Transformers capture both short- and long-term trends while accommodating future policy changes

- Quantile regression forests deliver a full distribution of possible outcomes, supporting more precise scenario planning across operations and finance

3. Pricing Optimization demands dynamic, AI-driven approaches that adapt continuously to market responses, unlocking potential gross margin gains of 3–7%. Advanced methods include:

-

- Multi-armed bandit algorithms rapidly test and shift toward optimal price points in real time

- Price elasticity matrices uncover bundling opportunities across product portfolios

- Contextual bandit models further refine pricing by incorporating customer segments, channels and timing, enabling tailored, value-capturing offers without lengthy feedback cycles

While these AI models offer powerful capabilities, they have limitations—selecting the right tool depends on context. Engaging experts helps identify effective strategies, enabling middle-market firms to apply advanced pricing methods once limited to large enterprises for targeted tariff responses.

From Volatility to Strategic Advantage

As we navigate this period of unprecedented tariff volatility, the difference between resilient companies and vulnerable ones increasingly depends on their analytical capabilities.

Organizations that embrace AI-driven decision intelligence develop the ability to:

-

- Quantify elasticity dynamics at granular product and segment levels

- Implement sophisticated pricing and inventory strategies

- Maintain capital flexibility despite operational disruptions

- Identify strategic opportunities within a volatile market environment

This article is sponsored by Teragonia. Teragonia provides an AI-based Value Orchestration platform for private equity backed mid-market operators, helping them transform fragmented operational data into an execution-focused view of business performance — With Teragonia, mid-market leaders align their data, decisions and actions to maximize top-line and margin growth. Connect with Teragonia at https://teragonia.com/contact/ to develop your tariff resilience strategy and transform volatility into strategic advantage.

Thomas Thayyil Thomas, Chief Executive Officer and Co-Founder, is a seasoned M&A advisor and value creation strategist, Thomas combines global transaction experience with deep expertise in analytics and enterprise technology. Prior to founding Teragonia, he led the design and development of a cutting-edge, highly secure data science platform at a leading investment bank, capable of supporting thousands of users and several hundred clients, enabling scalable, high-impact analytics applications across the deal lifecycle for leading financial sponsors and Fortune 100s. Prior to that he spent more than a decade at a Big 4 firm advising financial sponsors and global conglomerates on complex cross-border transactions, carve-outs, and IPOs.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.