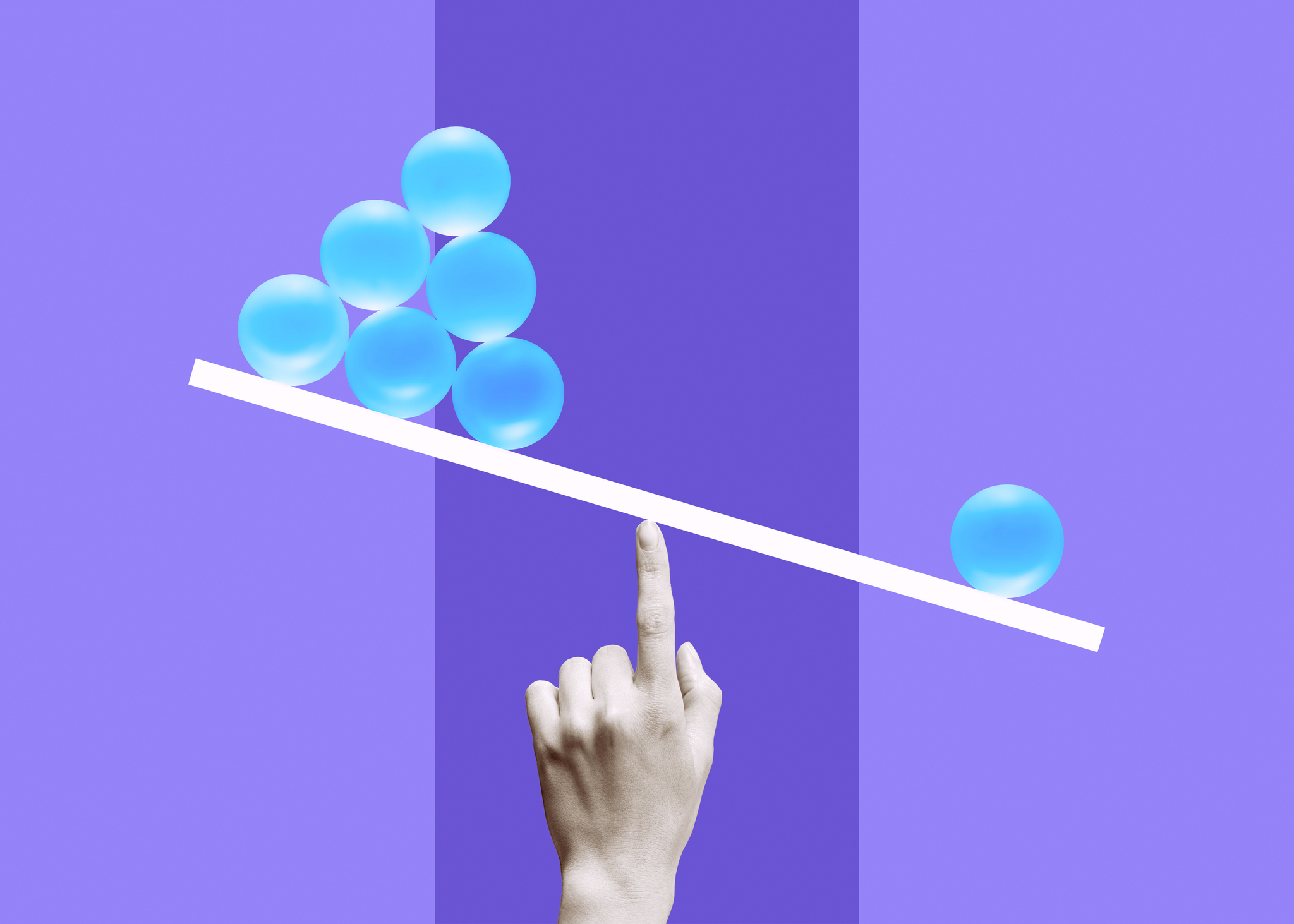

The Middle Market’s Supply-Demand Imbalance

The third quarter will continue to be slow for M&A activity, but deal makers should not be too pessimistic, says WhiteHorse Capital Executive Managing Director and CEO Stuart Aronson

It is fair to say that mergers and acquisitions activity has not unfolded as most had expected or hoped at the start of 2025. The year began with cautious optimism. Practitioners were penciling in strong double-digit M&A growth, deal structures were more aggressive and some speculated that activity might even approach the heady days of 2021. Of course, that outlook came to a screeching halt when the Trump administration announced reciprocal tariffs far in excess of what the market expected.

Since then, the M&A market has had to contend with persistent uncertainty around tariff policies, fears of a recession and an array of political policies that are generally considered inflationary—the tariffs themselves, deportations that impact the labor market in key industries (e.g., construction, hospitality and agriculture) and tax policies. Given the Federal Reserve’s commitment to fighting inflation aggressively, these policies could mean the reduction or elimination of the interest rate cuts the market has anticipated in 2025; it’s even possible the Fed could respond by raising rates. Indeed, given the relatively benign economic data in the second quarter, the inflation risk may now be greater than recession risk.

These are all headwinds to be sure, and the third quarter will continue to be slow for M&A activity, but deal makers should not be too pessimistic. Already the broader market has shifted from viewing tariffs as possibly permanent (a worst case scenario) to negotiating tactics, and there is a growing consensus that tariff policy will clarify as 2025 progresses. Given the backlog of PE firms ready to sell, there could be a rush of deals when the market turns.

The big question is whether tariff clarity comes in time to revitalize deal activity in the fourth quarter, or if we must wait until 2026. That is a potentially long hold up, especially for PE firms and limited partners itching to have realizations and put money to work. But the fact is that some deal activity will continue throughout 2025, largely for firms not affected by tariffs, which are concentrated in the middle market and lower-middle market where companies have less international exposure. For this reason, it is worth taking a close look at how different players are managing through the current uncertainty—and how they might still find and execute smart deals. Let us take them one by one.

Given the backlog of PE firms ready to sell, there could be a rush of deals when the market turns. The big question is whether tariff clarity comes in time to revitalize deal activity in the fourth quarter, or if we must wait until 2026.

Sponsored Deals

There is a notable supply-demand imbalance in the sponsored deal category. At the start of the year, according to bankers, many sponsored deals were cued up and ready to go. But sellers have pulled back. Even with the somewhat more sanguine economic outlook that has taken hold since the tariff announcements, many sellers have put their deals on ice. Their primary fear is that the base level uncertainty around tariffs and the possible economic slowdown means they will not get optimal pricing. The higher than expected base interest rates are also putting off sellers, reasoning that the enterprise value people are willing to pay will suffer. All these concerns are especially relevant for any company with exposure to tariffs or that carries recession risks.

On the other hand, there is a significant amount of PE capital that dealmakers want to put to work. As a result, there is enormous competition for any “clean deal,” that is, almost any deal without tariff or recession risk (e.g., many healthcare companies and certain companies in service industries) or any other material defect. But such is the hunger to put money to work that even some nonclean deals have recently gotten done on very aggressive terms.

For example, in the spring we saw one partially cyclical company seeking a refinance at 9.5 times adjusted EBITDA—representing almost its entire value stack. The banker on the deal planned to raise 4.0 turns of equity and 5.5 turns of debt, but the direct lending market was so hungry that we understand at least two firms offered the full 9.5 times debt. In another case, a consumer equipment manufacturer in China—with clear tariff exposure—refinanced debt at terms favorable enough to take out its previous lender. These extremely aggressive financings are examples of the lust for assets in the market today.

Non-Sponsored Deals

This corner of the market has been much less affected by the tariff turmoil and recessionary fears. The volume of dealmaking is steady, and the leverage for most deals remains in the range 3.0-4.5 times EBITDA. Separately, pricing in this market has moved only about 50 bps since 2023 compared to 150-200 bps in the sponsored market.

Pricing for middle market and lower-middle market non-sponsored deals has been especially stable because so few direct lenders actively operate in the space. Indeed, most direct lenders do not bother with these non-sponsored deals because origination and credit underwriting are so labor intensive. In terms of dollar volume per originator, we estimate that the non-sponsor market is only about 10% as efficient as the sponsor market.

Even so, WhiteHorse Capital is committed to the non-sponsor middle market and lower-middle market. In addition to New York and Chicago, where most direct lenders are based, we have 24 originators in 13 cities in places as far flung Los Angeles, Dallas, Cincinnati, Atlanta, Washington D.C., Miami and Boston.

One big reason the non-sponsored market is fairly insulated from the market turmoil is that dealmaking motivations are fundamentally different. In the sponsored market, PE firms are often selling to each other. They need to satisfy their LPs and, as noted, their overwhelming fear in the current environment is suboptimal valuation.

But non-sponsored deals are driven by factors other than valuations, such as an owner becoming sick and needing to sell, or an owner growing older and wanting to retire. These sales are relationship driven and usually involve local or regional competitors.

To illustrate the dynamics of the sponsored and non-sponsored market, consider the deal pipeline at WhiteHorse Capital. Usually about 25% of the deals we review are non-sponsored, but that percentage has recently bumped up to 40% or more. Moreover, the market’s stable pricing and fewer competitors mean that attractive deals are still to be had.

Syndicated Lending

This market segment for sponsored deals came to a halt with the tariff announcements and has not fully recovered. It is a volatile market that runs hot and cold and functions less based on the fundamentals of the company and more on the liquidity flows of collateralized loan obligations (CLOs). It is important to note the dynamics here. The banks leading these syndicates are not making credit decisions for their own balance sheets; instead they are looking to collect a fee by selling paper to dozens or even hundreds of lenders in the syndicate.

The arms-length relationship with these sometimes “emotional” lenders makes some PE dealmakers leery of relying on syndicate financing in general. They worry that the holders of their paper might sell rashly in the future to vulture investors who will try to take over the company. For this reason, some prefer direct lending, even though the terms are sometimes less attractive. In direct lending deals, fewer lenders are involved (typically one to four), they have a closer relationship with the company, a better understanding of the credit, and they intend to hold the paper on their own balance sheets and those of their investors. This all bodes well for stability going forward even in the event of a restructuring.

Direct Lending

Direct lenders are very aware of the risks that the economy will weaken. But compared to syndicate lending, direct lending has remained calmer through the recent market turmoil—and has even benefited somewhat from the pullback in syndicated lending. Even so, the pipeline at WhiteHorse Capital is about 90% of normal capacity, and the deal rejection rate is higher than normal because the quality of the deals we are seeing is lower on average than in 2024. Typically, we only reject 20%-25% of deals during the early deal review process, but that rate is now closer to 50% or even higher. Several increasingly common material defects are behind this higher rejection rate: customer concentration, highly adjusted EBITDAs, regulatory risks (e.g., healthcare reimbursement rates) and historically poor performance.

There is also the increasing specter of AI risk. Take, for example, a medical services company we recently considered. While AI is not advanced enough to duplicate its offerings today, one could easily see AI leapfrogging and replacing some of the company’s services within three to five years given the pace of development. Predictions of the future are always difficult, of course, but WhiteHorse Capital has internal AI experts, and we can also tap into a robust AI knowledge base at H.I.G. Capital, our parent company, to assess this risk.

While 2025 has proven much more challenging for M&A than expected, we believe dealmaking will pick up in 2026 and perhaps as early as the fourth quarter of this year. Inflation and recessionary fears will lurk, but rather than succumbing to the gloom, dealmakers should ready themselves for the inevitable market turn that unclogs the pipeline. We expect a flood of deals when that happens. The advantage will go to those who are prepared.

Stuart Aronson is Executive Managing Director and CEO of WhiteHorse Capital, which provides a wide range of customized financing solutions to non-sponsor and sponsor borrowers in the middle market.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.