Diverging Demand in Bank-Led Sale Processes

What’s driving high sponsor interest in some auctions and little engagement in others

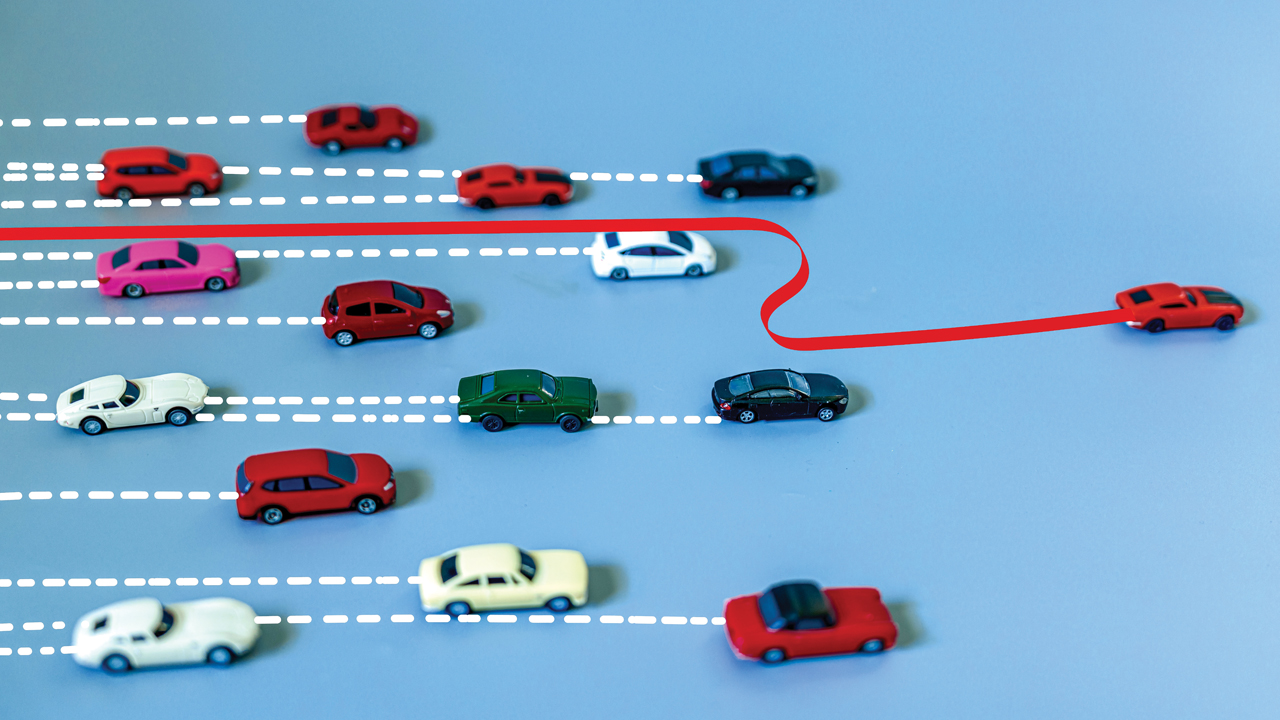

Middle-market deal flow from investment banks has become highly bifurcated in terms of competition within formal auctions.

On the one hand, we are seeing competitive bank-led sale processes garner significant interest, with 30 to upwards of 80 indications of interest. Yet simultaneously, we are also observing processes generating minimal interest.

Of course, we should always expect variance in the level of interest a bank-led process will attract. (Some businesses will always turn more heads than others.)

Notably, though, the current range of interest resembles less of a normal distribution and more of a barbell. The stark separation between the two sides warrants a closer look.

Behind The Bifurcation

Several notable factors are contributing to the divergence in buyer interest. They include:

Sector attractiveness. In a market where leverage inevitably has to come down due to elevated interest rates, PE groups have become more selective about where they invest.

Assets with strong end markets, solid growth potential and good margins that are not capital-intensive traditionally garner a lot of private equity interest—even more so in the current environment. This is evident in sectors such as consumer services, maintenance repair and overhaul, industrial services, marketing services, IT services and facility services, where closed deal volume for companies with $50 million to $500 million in enterprise value (EV) has collectively grown, even since the peak of 2021, according to data from SPS by Bain & Co.

Assets with strong end markets, solid growth potential and good margins that are not capital-intensive traditionally garner a lot of private equity interest.

Conversely, asset-intensive businesses in areas such as consumer products, building products, aerospace and defense, and general heavy manufacturing are garnering very little sponsor interest. Closed deal volume in those categories is down anywhere from 40% to 90% over that same time frame.

The result has been a huge shift in the closed deal category mix along with a smaller universe of attractive sectors—and, thus, a diminished population of deals attractive to the sponsor community.

Valuation expectations in out-of-favor sectors. There are contrarians in every market who pursue out-of-favor asset categories in hopes of investing at the bottom and ultimately making a return on the buy. Additionally, plenty of investors employ a value and/or relative value investment strategy, looking to buy “B” and “C” assets with the goal of turning an “OK” business into a great company.

But the reality for value-oriented investors is that many founders continue to anchor their valuation expectations based on prior years, creating a large bid-ask spread that inhibits deal activity with no pressure to transact.

Additionally, many sponsors invested in businesses at much higher multiples over the last five years compared to where trades are warranted in today’s environment. Consequently, they are very cautious and thoughtful about exit timing.

Lack of product at the upper end of the market. Deal volume lethargy at the upper end of the market ($500M+ transaction value) over the last 18 to 24 months has caused many larger funds to move down market as the pressure to deploy capital persists.

Toward that end, many groups had developed theses in certain sectors and have been motivated to invest regardless of an asset’s size, especially in consolidation strategies where they can put more capital to work quickly.

As an illustration, closed deal volume at the upper end of the market is down 55% compared its peak in 2021 and fell 25% YOY in 2023 to the lowest levels since 2016. The first quarter of 2024 marked the slowest annual start since 2016, according to data from SPS by Bain & Co.

The emergence of single-asset continuation vehicles has also taken a growing number of larger high-quality assets out of the market and provided general partners the opportunity to hold onto their winners for longer if they see continued opportunity for value creation while also relieving pressure to return capital to LPs.

Implications for PE Firms

Unsurprisingly, the bifurcated market results in far too much capital chasing too few deals at the lower end of the market. The increased competition has naturally resulted in higher valuations for in-favor assets. One example is the broader business services category, where valuation multiples jumped approximately 2x in 2023 compared to 2021 for deals in the $100 million-to-$250 million EV range, according to a GF Data’s 2023 M&A report.

Given today’s environment, PE firms should focus on sectors in which they have a competitive edge and differentiated angle. Those participating in frothy categories will need to pick their spots and double down on organic growth strategies and operational efficiencies to drive value creation. The ability to underwrite meaningful multiple expansion at exit is becoming more challenging in some sectors, as is the ability to blend down entry multiples significantly through add-on M&A, albeit to a lesser extent.

Additionally, some firms may consider starting smaller, pursuing assets further down market, and maintaining an open mind to doing more business-building to keep up with capital deployment.

What’s Next

While timing is anyone’s guess, there is a logical path to entering a more “normal” buyer demand environment. We are already seeing some positive signs of logjam relief. For one, lending is beginning to open up at the upper end of the market, typically a harbinger of future deal volume growth.

The U.S. economy continues to hang in there, which should further bolster overall investor sentiment. Each month, we get farther away from the COVID-19, supply chain and inflation disruptors of certain pockets of the market, which should result in more normalized business performance and instill investor comfort in re-engaging in disrupted sectors.

Finally, while seemingly fleeting of late, rate cuts later this year or next should also bring relief and serve as another catalyst to entering a more normal deal environment.

Alex Ray is a director of business development at Comvest Partners, where he is responsible for managing relationships with intermediaries, as well as originating new investment opportunities for the firm’s private equity strategy. He was featured in Middle Market Growth’s Private Equity Business Development Pros to Watch earlier this year.

Maneesh Chawla is a managing partner at Comvest Partners and head of the Private Equity strategy, where he is responsible for all key aspects the investment process including sourcing, transaction execution and portfolio company oversight.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.