Demystifying Percentage of Completion Accounting for Investors of Project-Based Businesses

Armed with proper due diligence, investors can gain confidence in companies with percentage of completion financials

The Percentage of Completion (POC) method in accounting often carries a veil of mystery and apprehension for potential investors of project-based businesses. It is a crucial yet complex part of financial reporting in the construction and industrial sectors, in which projects often extend over long periods.

POC accounting relies on significant estimates made by management to determine the timing of revenue recognition. This flexibility opens the door to potential manipulation, underscoring the importance of approaching POC financials with a high degree of diligence and caution. With momentum in the construction and engineering markets, investors should ensure they are well-equipped for analyzing POC.

Understanding Percentage of Completion

For most businesses, revenue is recognized when a product is sold and transferred to a customer. However, this approach is impractical for project-based businesses, especially those with projects that span months or years.

Instead, POC accounting requires managers to estimate monthly revenues by determining the total contracted revenue and calculating the percentage of completion based on costs incurred relative to the total estimated costs of the project. The goal is to align revenues as closely as possible with expenses.

However, estimating total project costs often involves significant judgment, presenting opportunities for shifting revenue recognition across periods. This complexity is compounded when dealing with hundreds or thousands of projects at a time, each estimated by different project managers who may bring their own biases to the determination of POC.

Real-World Application and Challenges

Analysis can be performed to present the financials of any closed project more precisely. However, it’s crucial to understand management’s tendencies or biases to better analyze ongoing projects. Monthly fluctuations in POC revenues do not always stem from management bias; for instance, a large-scale construction project could face unexpected delays and cost overruns. Early revenue and margin recognition might be reversed if the total project costs exceed initial estimates.

Commonly, revenue recognition is manipulated for beneficial timing related to tax obligations, commission payouts, or other economic reasons. This might lead managers to use conservative estimates early in the project, with a “true up” of revenue occurring towards the project’s completion. For investors, the challenge lies in evaluating recent months which might reflect more closed projects with significant revenue recognition.

Hindsight Is 20/20

In financial diligence, knowing the final total costs of all closed projects allows for a retrospective adjustment of when revenue should have been recognized based on the costs incurred each month and the actual project completion costs. This comparison can reveal whether management consistently employs a conservative, aggressive, or uniform approach to estimating costs and margins.

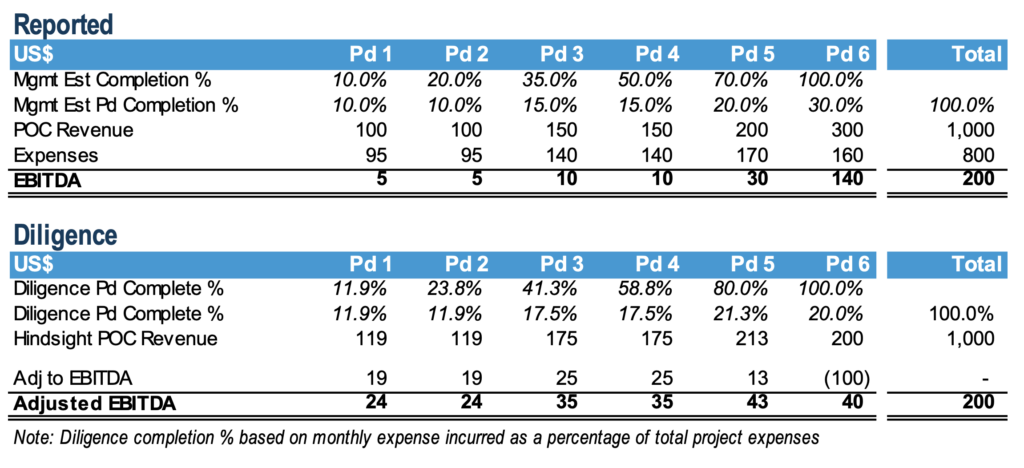

The example below shows a project where management assumed a conservative POC for the first five periods but ultimately closed the project in period six and recognized a large amount of revenue from the prior conservative periods. In diligence, by looking back at the specific costs, it can be determined exactly how conservative each month was, and revenues can be adjusted to the periods they relate. It is important for investors to keep in mind that any revised presentation of revenue will also have an impact on the calculation of net working capital, as the timing of revenue interplays with the determination of under-billings or billings in excess.

While this solves the issue for any closed project, there remains risk that bias exists in any open projects that still require management’s estimates. Diligence providers can recast those projects as well. However, instead of adjusting to known amounts for total costs, historical performance can be used as the estimate.

Total costs or total project margins can be used based on historical averages of margins for specific project types, historical margins for specific customers, margin that (was) used for the initial project bid, or any other relevant metrics that would limit management’s judgement.

Diligence is often thought of as process that buyers go through. However, diligence is also important for sellers as they prepare to present their business to the market. Sellers should get ahead of any issues, remove any perception of bias, and establish their understanding and expertise over the business and its finances.

Diligence is often thought of as process that buyers go through. However, diligence is also important for sellers as they prepare to present their business to the market.

Legislative Implications, Market Trends and Opportunities

Recent legislative developments, such as increased infrastructure spending growth in manufacturing plant construction and increasing demand for electricity, have brought the POC method into the spotlight. This projected spending is translating to a growing backlog and pipeline for engineering and construction services firms.

Financial buyers that historically shied away from the sector are becoming more interested in acquiring firms that will benefit from these mega spending trends. Understanding and properly analyzing the historical and projected performance of these firms, much of which involves projecting existing backlog and pipeline to future revenue and EBITDA, requires an understanding and application of POC analysis.

In addition to investors in the sector, lenders must also be prepared to apply POC analysis to properly gauge debt capacity at closing of a transaction and to set covenants for future periods. Working with experienced due diligence providers, and in cooperation with management, banks and direct lenders can play a significant role in the continued high level of M&A activity in the sector.

The engineering and construction services sectors remain highly fragmented, and opportunities remain for investors to acquire solid, well-managed firms at reasonable multiples. Understanding the fundamentals of how these firms bid, win, and manage projects is critical to finding and acquiring winning platforms. An experienced due diligence provider that understands the impacts of POC accounting and can apply that experience to help guide investors will be critical as these mega trends continue.

Investors historically were often wary of businesses that utilize POC accounting, particularly those that are founder-owned or in the middle market, due to the complexities and potential for financial obfuscation associated with this accounting method.

However, with detailed diligence and expert financial practices, companies can navigate the complexities of this method, turning potential risks into opportunities for growth and success.

Joe Randolph is Managing Director, Financial Due Diligence, Stout

Jim Owen is Managing Director, Investment Banking, Stout

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.