Strategic Industrials Investing Shows Signs of Promise

While private equity firms are hamstrung by high interest rates, strategics that typically fund deals with stock and cash are in a better position to transact in industrials

If high interest rates are the primary culprit keeping private equity M&A at bay, experts say strategic investors have a natural advantage.

They normally fund transactions with stock and cash, and little to no debt. Many have strong balance sheets and good cash flow, and stock prices have been on the rise this year. Some are willing to pay top dollar in deals without having to line up debt financing, experts say.

Other factors, like focusing businesses on core areas or adding technology and AI capabilities, are driving corporate acquirers in the industrials sector to do more deals this year, investment bankers say.

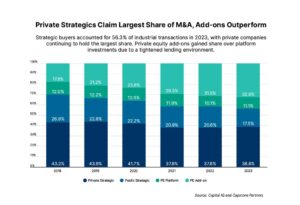

“For many years, up until the last 18 months or so, debt financing for acquisitions was inexpensive and that created an odd dynamic, where private equity firms were outbidding strategic acquirers in some cases. As rates have risen, that dynamic seems to be turning back in favor of strategics,” says Larry Gelwix, partner and head of industrials at Solomon Partners. According to research from investment bank Capstone Partners, strategic buyers made up 56.4% of industrials M&A in 2023.

Content continues below

While middle-market deals don’t require as much capital, some mega industrials deals could signal that the M&A market is recovering and companies are well capitalized for transactions. In the large-cap industrials space, Clarience Technologies bought Safe Fleet Holdings from Oak Hill Capital Partners, and The Home Depot recently acquired SRS Distribution for $18 billion. Leonard Green Partners had invested in SRS in 2018 for $3 billion, and the company was placed in a continuation fund with Berkshire Partners last year.

Strategics—by definition—also have a natural advantage when adding capabilities or merging businesses where there is a strategic fit or an opportunity for unlocking synergies, says Gelwix. “M&A is an important corporate finance tool in many corporations’ growth strategies,” he adds.

Mike Lindemann, managing director and co-head of Baird’s Global Industrials Investment Banking Group, says that he usually sees strategics and sponsors equally involved and competitive in the industrials M&A space, but recently it’s tilting about 60/40 in favor of strategics “who have an inherent valuation advantage because of high interest rates.”

Motivations to Transact

Patrick Nally, managing director and partner in William Blair’s Industrials Growth Products group, says that companies in the building products subsector are trying to bolster their product set and capabilities. “They are trying to be solution-oriented, build up a portfolio of products and be a one-stop shop for their customers.” Nally adds that he is seeing opportunities across the commercial, infrastructure and residential sectors, driven by new office-use dynamics and government investment in infrastructure.

Since hybrid work took hold post-pandemic, businesses are more focused on “providing a desirable experience for their employees and building an attractive spot for them to be,” Nally notes, which is what’s driving some of the demand in the sector.

William Blair advised Rytec Corporation on its pending sale to Nucor Corporation. Charlotte, North Carolina-based Nucor is a publicly traded provider of steel and building products solutions for building and other industrial applications. Rytec is a manufacturer of high-speed rolling doors for various commercial end markets. The deal was struck at $565 million in cash, 12.5x Rytec’s expected 2024 EBITDA, according to an announcement in June.

William Blair also recently advised MTL Holdings on its sale to Carlisle Companies from private equity firm GreyLion Partners. Scottsdale, Arizona-based Carlisle is a publicly traded supplier of building products and solutions for more energy efficient buildings. MTL is a provider of prefabricated edge metal for commercial roofing. The deal was struck at $410 million in cash, or 8.7x MTL’s EBITDA, according to an announcement in March. The EBITDA multiple translates to 14x when taking into account pro forma synergies and a tax benefit, Nally says.

In some cases, private equity firms are keen to sell companies to strategics because many are in cash-positive situations, their stock prices have been rising and they are more reliable buyers that can close deals quickly, sources say. In the MTL auction, for example, the company had selected Carlisle as the winner on a Friday and the deal was signed and announced on Monday, Nally says.

“Strategics have been aggressive in closing deals, but you are starting to see private equity firms come back because we’ve at least reached stability with interest rates,” Nally says. In other cases, though, founders who are interested in continuing to run the business and not have it be subsumed by a larger strategic are more interested in private equity buyers. William Blair also recently advised MDC Interior Solutions, a commercial wallpaper and design company, in its sale to Norwest Equity Partners. “The business was led by a fourth-generation family member who was excited to continue their growth strategy with another PE partner and not a strategic,” Nally says.

Sector Specialization

Nally focuses on infrastructure and commercial and residential building products at William Blair, where the group has closed seven M&A sell-side transactions with a combined enterprise value of over $3 billion so far in 2024. The Industrials Growth Products group also has many other subsector specialists.

Other investment banks have taken a similar approach to specialization, given the wide-ranging nature of the industry.

“There is this joke that industrials is everything that’s not something else,” says Solomon Partners’ Gelwix.

Gelwix joined the firm in 2022 from investment bank Greenhill & Co. and focuses on two main areas: aerospace and defense, and mission-critical “techier” industrials. The latter category encompasses things like automation, motion control, flow control and industrial software. “I believe—and this is also an ethos of the firm—that industry specialization is critical to our ability to serve our clients,” Gelwix says. Solomon Partners and Jefferies recently advised Belcan on its planned sale to publicly traded engineering, research and development company Cognizant for $1.3 billion. Belcan, which is owned by AE Industrial Partners, is a supplier of design, software, manufacturing, supply chain, IT and digital engineering services to the aerospace and defense markets.

The firm has about 10 people in its industrials group. Gelwix is tasked with building out the team, which he sees as broadening out from those two core subsectors. “We want to hire in the closest adjacencies to the things we already do,” he says. This could mean adding specialists in government services, space and defense, industrial technology or other pockets of Solomon’s specialties.

Baird’s Lindemann, meanwhile, says he’s watching “mega-trend growth opportunities” like AI/data centers, power, cooling, electrification and grid infrastructure, where many financial and strategic buyers are spending their time. In another recent sponsor-to-strategic deal, Baird advised ECM Industries, a Wisconsin-based manufacturer and supplier of electronic connectors, tools and test instruments, in its sale to nVent Electric plc for $1.1 billion at about 10.6x EBITDA, according to a deal announcement last year. ECM was previously owned by Sentinel Capital Partners.

Bankers hope that the mismatch on valuation expectations between buyers and sellers in recent years will start to fade, leading to a more fruitful market. “One of the themes in 2023 was a misalignment of buyer and seller valuation expectations, and that had a material impact on what ended up being lower M&A volumes in 2023,” says Gelwix. “I think part of the increase in volumes that we see so far in 2024 means a bit more pragmatism between buyers and sellers about the environment we’re in.”

Lindemann believes 2024 will be a recovery year and that deal volume should be up meaningfully. Clients that want to steer clear of potential election volatility will also be motivated to transact before November, while next year could bring some interest rate relief. “I think 2025 could be a substantial year. Interest rates will likely be declining early next year, which will catalyze deal activity and create a lot of volume,” he says.

Anastasia Donde is Middle Market Growth’s senior editor.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.