Pent-up Energy Could Drive FinTech M&A Wave

Experts say FinTech has potential for synergies and strategic partnerships—across PE-backed platforms and strategics alike—that could drive a dealmaking burst this year

The financial technology ecosystem wasn’t insulated from the widespread challenges plaguing the overall tech market in the past year.

Yet as one of the relatively younger segments of the tech sector, FinTech sits advantageously with dealmakers as a market with high growth potential, a need for consolidation and a newfound level of maturity that has strategics and private equity sponsors alike eager to strike deals.

This section of the report originally appeared in the Special Digital Report: Tech issue, sponsored by TresVista. Read the full report here.

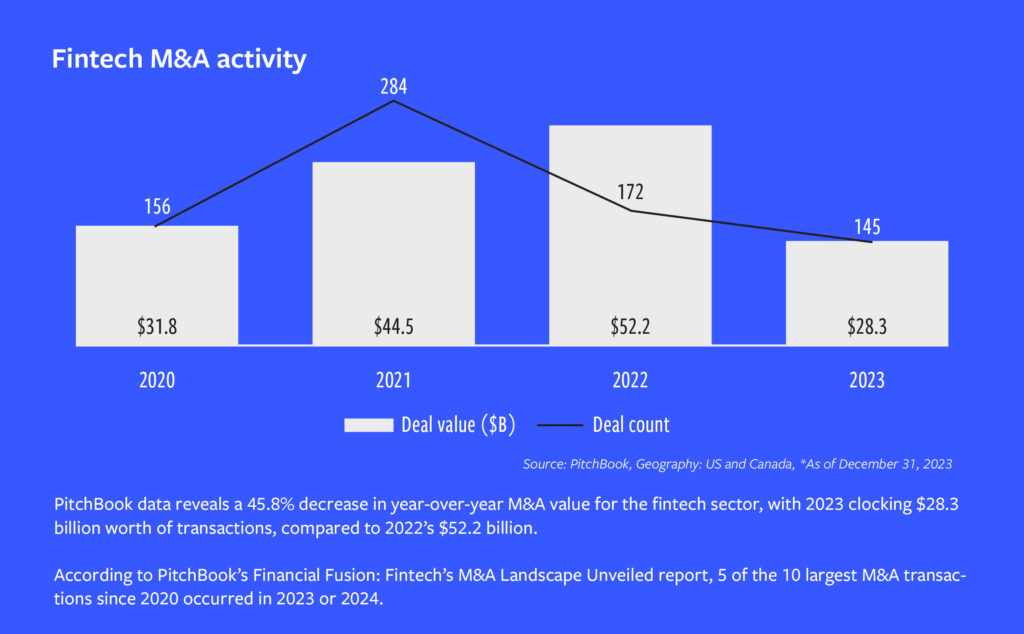

That’s not to say the FinTech market hasn’t been hit hard by the broader M&A slump dealmakers saw in 2023. Pitchbook data reveals a 45.8% decrease in year-over-year M&A value for the sector, with 2023 clocking $28.3 billion worth of transactions, compared to 2022’s $52.2 billion. Some of the pent-up potential for consolidation could prove to be a boon to the sector this year and beyond.

Rudy Yang, senior analyst, emerging technology at PitchBook, shares an optimistic outlook for fintech dealmaking this year. “It’s been a muted few months for FinTech M&A,” he says, “but there have been some bright spots in Q1.”

Those bright spots, he and other sources tell Middle Market Growth, are indicative of a more active year ahead as PE investors take advantage of long-term growth potential, and as corporates gear up to augment their service offerings through strategic dealmaking.

Coming to a (Delayed) Head

Part of fintech’s appeal to dealmakers is its diversity. “There are a lot of different subsegments within the FinTech space,” notes Mike Andrusko, a partner at Centri Business Consulting and leader of its Digital Asset Practice. “You have RegTech, wealth tech, InsurTech is starting to get bigger, and even digital assets I would say are going to fall within the fintech space.”

In addition to those newer niches of FinTech, areas like payments, banking and CFO technologies like treasury and cash management solutions contribute to a prolific market that has matured since its early startup days 10-15 years ago, when many of the businesses in the segment were simply “financial services companies utilizing technology” rather than genuine FinTechs, according to Ganesh Rao, leader of the financial technology and services investment group at private equity firm THL.

Rao says certain fintech niches are key to the firm’s investment strategy. InsurTech, bank technology, and fund and wealth technology are a few focuses for THL, which also looks for FinTechs with an opportunity to embed additional financial services, like payments capabilities, within existing platforms.

Despite the sector’s diversity, dealmakers say FinTech hasn’t seen the level of dealmaking activity that experts had anticipated by now.

“A lot of analysts, including myself, came into last year expecting there to be a wave of consolidation within the space,” says Yang, who cites fintech startups taking advantage of the low interest rates and bloated venture capital funding of recent years (2021, a banner year for FinTech and private equity funding alike, saw $121.6 billion funneled into fintech startups). “We and a lot of stakeholders in the industry expected a lot of startups to have a greater need for cash, and a lot more startup failures. What we’ve seen so far is that it hasn’t really materialized.”

Closing the Valuation Gap

According to Yang, much of the holdup of fintech M&A can be traced back to the dreaded buyer-seller valuation gap that has plagued so many industries in the last year, particularly in tech. Luckily, he says, that’s expected to ease as 2024 progresses.

And Max Heller, Centri’s managing director and leader of its M&A advisory practice, says buyers are eager to jump when sellers compromise. “We’re seeing lower valuations as an investor advantage,” he notes. “Buyers are capitalizing on that, and there’s more of a meeting of the minds.”

Overall, sector experts are confident that 2024 and beyond will finally be the time when long-awaited consolidation occurs.

Overall, sector experts are confident that 2024 and beyond will finally be the time when long-awaited consolidation occurs.

Rao expects Q2 to be a particularly telling period, especially when it comes to sellers’ readiness to go to market with tempered value expectations. LPs putting pressure on PE firms to return capital should also be a driver of dealmaking activity this year, he adds.

While dealmakers don’t anticipate a wave of fintech consolidation until at least later this year, some deals are getting done. Last October, Celero Commerce, a non-bank payment processor and portfolio company of lower middle-market PE firm LLR Partners, announced its acquisition of electronic payments company Finical. A month later, PE investor Advent International revealed its takeover of U.K. payments company myPOS, valuing the company at $500 million. And in January, tech-focused PE firm Welsh, Carson, Anderson & Stowe announced its acquisition of EquiLend, which provides technology to the global securities finance market processing industry.

“We’re starting to see some encouraging signs,” says Sam Ryder, a principal at LLR, who points to interest rate stabilization and projected cuts later in the year.

Several LLR portfolio companies completed add-on acquisitions in 2023. LLR targets growth-stage FinTechs with revenues of between $10 million and about $100 million. Ryder says businesses with high recurring revenue profiles and high retention rates are the most attractive, as are the companies that can replace legacy systems in areas like wealth management, banking and payments.

THL, says Rao, also seeks non-cyclical companies, ideally in end markets where software and technology penetration are in their earlier stages of long-term penetration. Most importantly, he notes, is the health of the end-customer. Fintechs servicing small community banks, for example, warrant a bit more caution at this time.

The Strategic Advantage

It’s not just PE sponsors strategizing their FinTech investments for the years ahead. Strategics have historically played a particularly important role in industry consolidation, with some big-ticket transactions continuing to make headlines today.

According to a recent Pitchbook report, five of the ten largest FinTech M&A transactions since 2020 occurred in 2023 or 2024, including the $11.7 billion acquisition of financial services data vendor Black Knight by Intercontinental Exchange in September, as well as Nasdaq’s November acquisition of Adenza, a financial services risk management and regulatory reporting company, for $10.5 billion. (Adenza was acquired from its previous owner, software private equity firm Thoma Bravo.)

Although dealmaking by strategics in the middle market is more muted, there are opportunities for synergies and partnerships, experts say.

According to Centri’s Andrusko, much of the inertia behind FinTech M&A this year and beyond will lie in identifying strategic growth potential, from strategics and PE-backed platforms alike. “There are certain companies that may not necessarily have a license, so instead of going through the application process, they may go through an acquisition to get into a company that already has that infrastructure to help them save some time, effort and money,” he says.

“I bet you’re going to see more strategics partnering up and identifying potential targets,” predicts Heller. “Probably a trend for ’24 is more strategics at play—but that could be private equity-backed platforms doing add-ons, too.”

Yang similarly highlights the value in strategic partnerships within the FinTech ecosystem, not only to consolidate a fragmented market and weed out the winners from the losers, but to enable companies to enhance and augment their existing offerings. With business and consumer end-customers demanding holistic, seamless products, industry collaborations can help banks, corporations and other industry mainstays expand into new geographies and add product functionality—injecting meaningful revenue into the business as a result.

That demand lends itself well to M&A, particularly as the FinTech ecosystem matures. “You’ve reached this point in FinTech where bank incumbents, large corporations and startups are all more ready than ever to partner with each other,” says Yang.

Carolyn Vallejo is Middle Market Growth‘s digital editor.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.