PE Fundraising Expected to Recover, Buoyed by Increased M&A

Placement agents and managers of recently raised funds talk about winning over LPs in a slower economic environment

Private equity fundraising numbers were one of many metrics to suffer last year as high interest rates and geopolitical headwinds weighed on dealmaking. This year, however, placement agents and other advisors say they are looking forward to a better year for fundraising as M&A recovers—to an extent. Delivering exits and returns to LPs is one of the best ways to go about launching a new fund, experts say, and as M&A improves, so should fundraising.

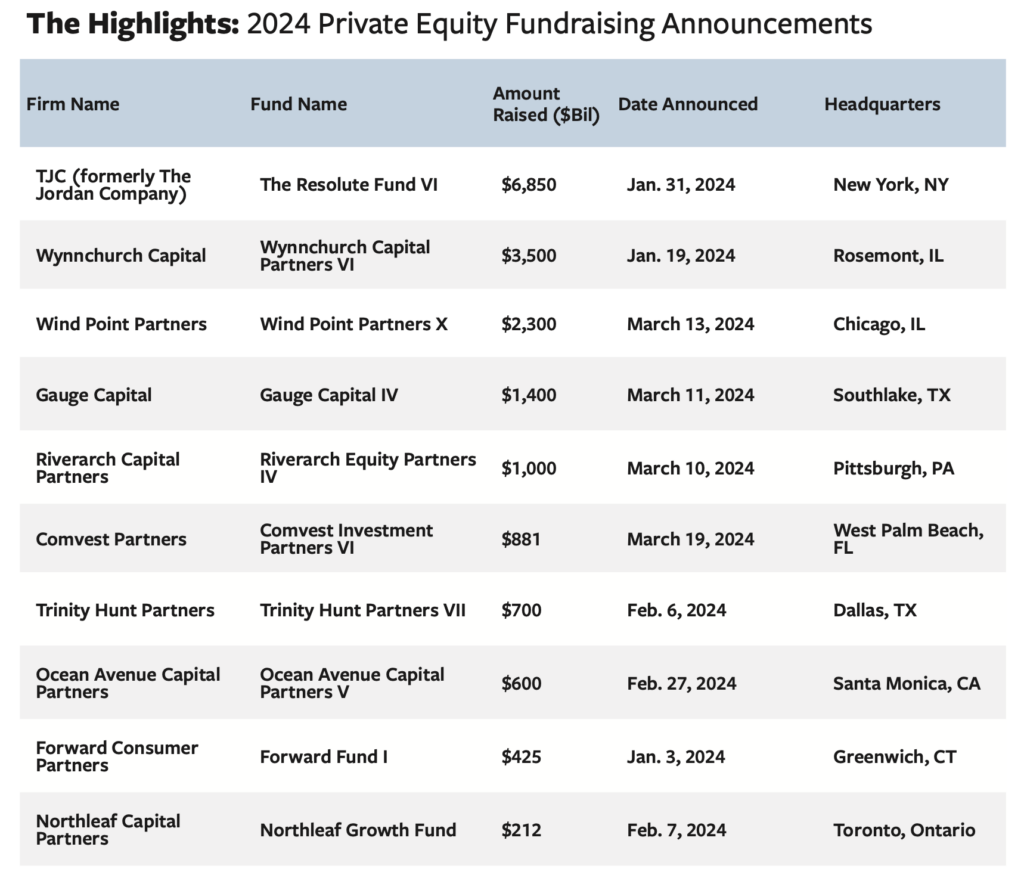

At the time of writing, first quarter numbers weren’t yet available, but multiple mid-market firms had announced fund closes at the beginning of the year. Firms operating at different ends of the middle-market spectrum say they are seeing traction with investors for different reasons.

Lower middle-market firms are still seeing deals and exits because founders of smaller companies are motivated to sell despite market calamity (or perhaps because of it). Other private equity managers operating multibillion-dollar funds are winning mandates with international investors and say LPs like the safety of brand names and well-diversified strategies.

“It feels like 2024 is off to a better start than last year. There is more deal activity, which sends distributions back to LPs, public market performance is improving and there are a number of groups raising new capital,” says Jerome Wallace, managing director and co-head of Private Capital Advisory at William Blair. The Chicago investment bank launched its PCA business in 2022 after hiring Wallace and several other executives from Credit Suisse’s fund placement business.

Chris Webber, managing director at placement agent Monument Group, agrees: “There are more opportunities hitting the market to provide liquidity.” Realizations for LPs should speed things along for managers raising new funds, he says.

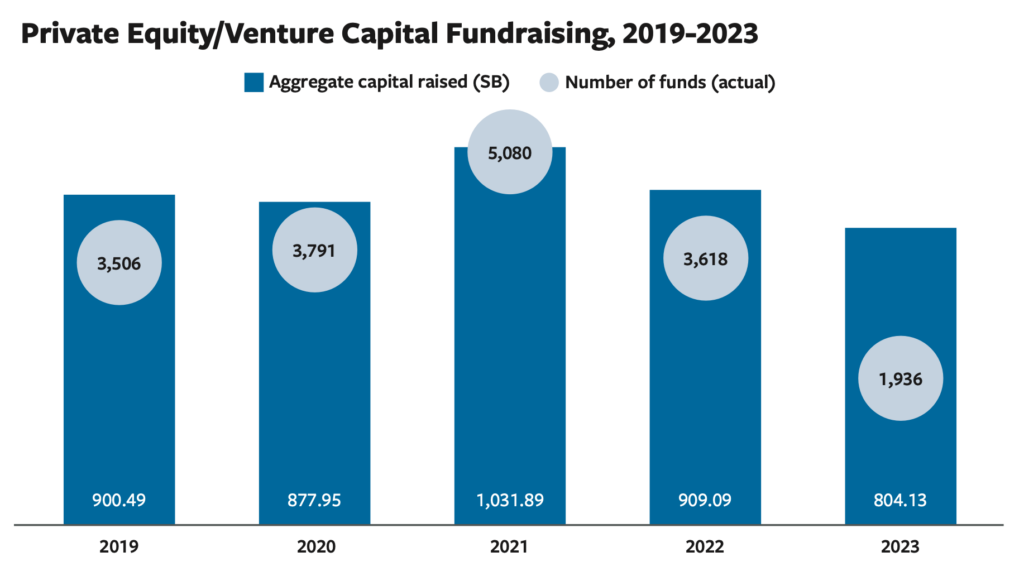

According to Preqin data compiled by S&P, there were 1,936 private equity and venture capital funds that raised capital globally last year, compared to 3,618 in 2022. That’s contrasted against the 5,080 fundraises in 2021 and 3,791 in 2020. According to Preqin analysis, private equity fundraising is expected to come back to 2021 levels by 2028 in terms of dollar value. PE funds in North America collected $364 billion in 2021.

Investors in different size funds have varying priorities, says Wallace, whose firm typically works with funds ranging from $500 million to $5 billion. Investors in smaller funds are often “looking for new, up-and-coming managers or specialized strategies. And they expect the lower middle market to generate outsize returns,” Wallace says. Larger allocators, like public pension funds and sovereign wealth funds, are typically writing sizeable tickets that only big brand-name fund managers can accommodate, he adds.

The Advantage of the Lower Middle Market

Several middle-market firms closed sub-$1 billion funds in the beginning of the year, including Trinity Hunt Partners, Ocean Avenue Capital Partners and Forward Consumer Partners. These firms typically play in the lower middle market, where they argue deals are still happening and fund returns are higher.

Trinity Hunt Partners closed its Fund VII in February at a $700 million hard-cap and took less than five months to raise the capital.

Story continues below

Data compiled Jan. 12, 2024.

Analysis includes private equity and venture capital funds with final close between Jan. 1, 2019, and Dec. 31, 2023. Funds in the analysis are limited to venture capital, balanced, buyout, co-investment, co-investment multi-manager, direct secondaries, fund of funds, growth, hybrid, hybrid fund of funds. PIPE, secondaries, or turnaround fund types.

Source: Prequin Pro; © 2024 S&P Global

Blake Apel, managing partner at the firm, says Trinity Hunt’s strong track record helped win over LPs. “Investors are looking for specialized GPs that can repeatably drive alpha, and we were able to prove that we had a specialized value creation strategy,” he says. A majority of capital in the fund was from returning LPs, including insurance companies, pension funds, endowments and consultants.

A significant amount of LPs realize buyout capital skews to large-cap and mega-cap funds because of the brand halo, but returns have actually been better in funds focused on small-cap transactions.

Blake Apel

Trinity Hunt Partners

“A significant amount of LPs realize buyout capital skews to large-cap and mega-cap funds because of the brand halo, but returns have actually been better in funds focused on small-cap transactions,” Apel says. Trinity Hunt invests in founder-owned companies in services sectors. The businesses the firm looks at typically have $2 million-$10 million in EBITDA. “A large part of our strategy is unlocking substantial growth by getting the right talent into the smaller companies that we acquire,” he adds.

Despite the tough fundraising environment, some new funds and new firms with specialized strategies have completed capital raises. Greenwich, Connecticut-based Forward Consumer Partners closed its debut fund at $425 million in December after a six-month-long fundraising process, according to a January press release. The firm focuses on branded consumer businesses, and its founders hail from private equity firm L Catterton and consulting company McKinsey & Co.

Story continues below

Source: press releases

When it comes to new funds, the pedigree of the fund managers is one consideration, says Wallace. “The repeatability of what they’ve done previously is also important,” he adds, explaining that if a portfolio manager goes from doing mega-cap deals to small-cap, the strategy might not be very transferable.

Northleaf Capital Partners is one example of a firm that took its experience in other strategies to launch a new fund. The Toronto-based firm, which has $24 billion in assets under management across private equity, private credit, infrastructure and secondaries, announced the closing of its first Northleaf Growth Equity Fund at $212 million in February. The firm is leveraging its experience in other strategies, like funds-of-funds, venture capital and secondaries, to invest directly in tech and healthcare companies, according to Mike Flood, managing director and head of private equity. Part of the strategy is repricing assets that were sold at high valuations prior to 2022 and don’t have a clear path to an IPO or other exit. “It’s a well-timed strategy and well-positioned in the secondary market to reprice valuations that were established prior to 2022,” Flood says. The fund was 40% invested as of February across 12 companies. Flood notes a significant amount of capital in the fund came from investors in Northleaf’s other strategies who seeded this vehicle.

Safety in Numbers

While the small-cap market has its advantages, larger firms continue to rake in billions. Experts say they benefit from brand names, an international LP base and the security investors find in diversified generalist strategies. Firms that operate in the middle market and raised larger funds in the beginning of the year include TJC, Wynnchurch Capital, Gauge Capital and Wind Point Partners.

Related content: Firms Focused on Smaller Deals Find Fundraising Success in a Challenging Year

TJC announced the closing of its $6.85 billion Resolute Fund VI in late January. The firm invests in companies with $100 million to $2 billion of enterprise value. Kristin Custar, partner and head of global investor capital at TJC, admits fundraising was challenging last year and that U.S. investors were much more constrained, with some LPs having trouble adding new relationships or even re-committing to existing PE managers. “We talked to one large investor that had their budget slashed by half,” she says.

New York-based TJC, previously known as The Jordan Company, benefited from an international LP base: 65% of the investors in its new fund came from outside of the U.S. “I spent a lot of time on planes,” Custar says. The firm had strong support from pension funds in Latin America and Europe, as well as a lot of exposure to investors in Japan, China, Singapore, Indonesia, Malaysia and the Middle East.

“There continues to be strong interest abroad for high-quality U.S. managers,” says William Blair’s Wallace. New York-based Kelso & Company closed its Kelso Investment Associates XI fund in September at $3.3 billion with capital also coming in from many investors abroad. The fund’s LP base included investors in Europe, Asia, Latin America and Australia, according to Lynn Alexander, head of investor relations and fundraising.

Custar says TJC’s consistent, well-diversified strategy of investing in middle-market U.S. buyouts works with investors. Additionally, TJC had several exits last year, she adds. “We were one of the only GPs calling our investors about distributions.” The Jordan Company invests in four core areas: consumer and healthcare, diversified industrials, logistics and supply chain, and technology and infrastructure. Industrial technology was recently carved out as a dedicated vertical within the diversified industrials target sector.

Kelso & Company also invests through a diversified strategy across four sectors—financial services, business services, healthcare services and consumer. “We’re interested in durable, recession-resistant businesses that we can grow organically and through acquisitions,” Alexander says.

Still, the environment feels slower than normal and interest rates continue to be high, although they’re not expected to keep rising. “I’m optimistic about 2024,” says Jessica Mead, regional executive for North America at fund administrator Alter Domus. “Hopefully we’ve seen the peak of interest rates and firms are starting to unlock the value of assets in M&A.”

Anastasia Donde is Middle Market Growth’s senior editor.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.