Healthcare Services Sector Gains Strength

Deal activity looks likely to rise amid an overall M&A rebound; cardiology and home health and hospice are two categories to watch

The U.S. healthcare services subsector continues to draw investor interest thanks to an aging population, rising obesity, a shift toward outpatient care and increased adoption of value-based care models.

They’re among the drivers that have spurred continued M&A activity on the part of private equity investors and strategic acquirers in categories like primary care, oncology services, behavioral health, cardiology, and home health and hospice, despite a relatively slow year for M&A overall.

This section of the report originally appeared in the Special Digital Report: Healthcare issue, sponsored by Sourcescrub. Read the full report here.

PwC’s 2023 midyear outlook noted that megadeals valued above $5 billion accounted for over half of the announced healthcare services deal value in the 12 months ending May 15—a figure consistent with the prior two years. The report showed relatively steady enterprise value to EBITDA multiples over the past year but a marked drop from 2021. As of mid-May, healthcare services companies traded at 13.6x on average, compared with 13.7x at the end of 2022 and 15.9x at the end of 2021.

There were 263 healthcare services transactions announced in the second quarter of this year, including 132 by strategic buyers and 131 by private equity firms and PE-backed companies, according to a report from healthcare-focused investment bank Provident Healthcare Partners, citing PitchBook data.

There were 263 healthcare services transactions announced in the second quarter of this year, including 132 by strategic buyers and 131 by private equity firms and PE-backed companies, according to a report from healthcare-focused investment bank Provident Healthcare Partners, citing PitchBook data.

Two areas within healthcare services worth watching are cardiology, and home healthcare and hospice, both of which reflect tailwinds benefiting the overall sector, while offering distinct advantages to investors.

Follow the Heart

An aging population and rising obesity rates are contributing to private equity’s interest in cardiology, as is an uptick in outpatient procedures approved by Medicare.

Those dynamics appeal to private equity firms, whose involvement in cardiology began in earnest within the last two years, according to Eric Major, a managing director at Provident Healthcare Partners. “I think investors feel that there’s a shift occurring within cardiology to the outpatient setting,” he says. “Historically, it’s been a hospital-based service.”

Related content: Healthcare Deal Sourcing: How to Evaluate GenAI Impact on Value

Also drawing investor interest are new ancillary services offered by cardiology groups, such as remote patient monitoring, chronic care management, advanced imaging services such as PET/CT scans, weight loss management and nutrition counseling. “There are just a lot of opportunities for these cardiology practices, given that they’re serving effectively as the primary care provider for those patients who have chronic heart issues,” Major says.

Webster Equity Partners is among the active investors in cardiology, via its platform Cardiovascular Associates of America (CVAUSA). The company’s CEO, Dr. Tim Attebery, formed CVAUSA with Webster Equity in 2021 to bring together cardiovascular group practices while enabling specialists to retain autonomy and ownership. CVAUSA has acquired 17 practices as of September, and Attebery expects that number to reach 24 or 25 by the end of this year.

Other active acquirers include Ares-backed US Heart & Vascular, which formed in 2021 and has since established partnerships with practice affiliates in Arizona, Texas and Kansas.

In February, Lee Equity Partners announced a new platform, Cardiovascular Logistics, to build and support a network of U.S. cardiovascular practices. The platform announced its partnership with First Coast Cardiovascular Institute, a network of 38 providers in the southeastern U.S., in April.

Major estimates there are around 12 PE-backed cardiology platforms today in total.

Although private equity’s involvement is recent, the cardiology space isn’t new to consolidation. Attebery points to the passage of the federal Deficit Reduction Act in 2005 as a watershed event for the industry.

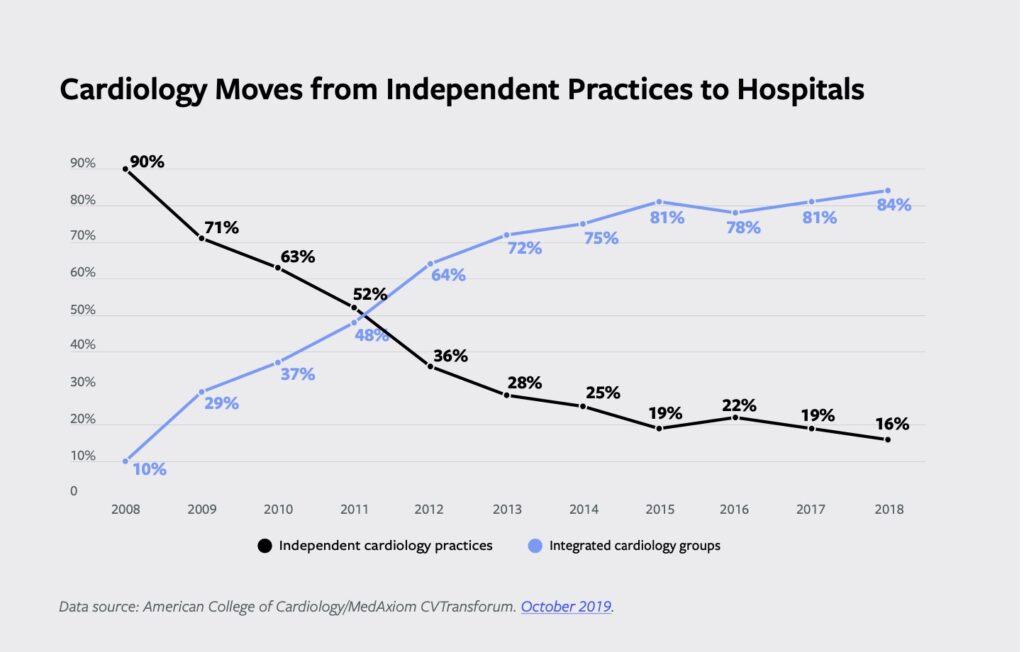

The law, which cut reimbursement rates for independent cardiologists starting in 2006, prompted many to sell their practices to hospitals. “We went from a very low percentage of hospital-employed cardiologists prior to 2006—maybe less than 10% [employed by hospitals], to within five years after that, it’s 80%,” says Attebery, who estimates there are now about 750 independent cardiology practices across the U.S.

Ultimately, the Deficit Reduction Act failed to save money, Attebery notes. “Hospitals owning and employing cardiologists has resulted in two bad things: increased cost and very unhappy cardiologists,” a group that he calls “entrepreneurial by heart.”

As their contracts with hospitals expire, some cardiologists may be interested in reestablishing their own practices with help from investors. “[The PE firm] can invest into their practices, into the equipment and all the cap ex that they need to move back into private practice, and then hopefully maintain relationships with the health system as much as they can after that transition,” Major says.

Home Health & Hospice

As with cardiology practices, demand from an aging population and the promise of lower care costs have spurred steady M&A in the home health and hospice arena.

A Q2 report on healthcare trends from KPMG estimated that the post-acute care sector accounted for 16% of healthcare M&A volume in the quarter. Notable transactions include the $3.3 billion acquisition of home health provider Amedisys by Optum, a UnitedHealth subsidiary, in June.

The home health and hospice category is highly fragmented, creating continued room for consolidation. Data from Sourcescrub, a deal sourcing platform for M&A teams, suggests there are 2,636 mid-market home health and hospice companies in the U.S. with between 100-2,000 employees. Of those businesses, 228 are backed by private equity sponsors, while 1,217 are independently operated.

The home healthcare and hospice sector is attracting some of the highest valuation multiples in healthcare, according to a recent report from Kroll. Multiples based on the last 12 months’ EBITDA averaged 14.5x, compared with 11.5x for the healthcare industry overall.

Related content: Navigating the Turbulent Waters of Healthcare Mergers and Acquisitions

Dan Harknett, a partner at private equity firm Ridgemont Equity Partners, says hospice has been an attractive segment of healthcare for his firm because of the United States’ aging population, patients’ preference to be at home and the lower costs associated with delivering end-of-life care at home compared with a hospital setting. “To quantify that, it’s roughly 90% less expensive per day,” Harknett says. Two years ago, Ridgemont invested in Agape Care Group, which provides hospice services in the Southeast.

The hospice sector will benefit from a reimbursement rate increase of 3.1% for the 2024 fiscal year, announced by the Centers for Medicare & Medicaid Services in July. The adjustment follows similar increases in recent years. At the same time, industry-watchers say the category will face increased scrutiny from regulators, adding time and compliance expenses for hospice operators.

Meanwhile, home healthcare businesses will face a modest decrease in Medicare reimbursement rates next year. Industry-watchers and prospective buyers are cautiously waiting to see if other cuts will follow in 2025.

Even with those headwinds, merger and acquisition activity is expected to continue within home health and hospice.

“I think there’s continued M&A momentum in the category,” Harknett says.

Katie Maloney is ACG’s content director.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.