Rise of the Talent Head in Private Equity

As PE pays closer attention to human capital, how can talent executives demonstrate value?

Most business decision makers realize that human capital can drive significant value and growth for a company outside of hiring, firing, and retaining talent. Private equity firms have seen the impact talent executives are having on the bottom line and have shifted to make the role of talent executives a key focus for their firms.

This comes at a time when PE firms are increasing their involvement in the day-to-day operations and performance of their portfolio companies and engaging more intimately with management teams to generate greater returns faster. However, talent executives at many PE firms must work through a growth and ‘prove it’ process as they earn the respect of investors, deal partners and portfolio CEOs by demonstrating value. How are talent executives doing this?

A common mistake investors make is undervaluing talent’s role in generating returns.

Increasing the Focus on Talent

Twenty years ago, private equity had zero interest in human capital beyond replacing CEOs and CFOs. It was all about financial engineering, leveraging debt and driving returns. Ten years ago, the larger PE firms started focusing on talent and began adding heads of talent. Today, our experience at Summit Leadership Partners shows that roughly 80% of PE firms with assets under management exceeding $5 billion have a talent executive in charge of the talent and organization performance in their portfolio companies. High-performing companies spend 1.5 to 2 times more on leadership and organization initiatives than other companies, and they see triple or quadruple the payback.

A common mistake investors make is undervaluing talent’s role in generating returns. However, Summit Leadership Partners’ research has found that portfolio company leadership has a 15% impact on financial performance and a 30% impact on market valuation. Summit also found that almost 50% of U.S. PE firm operating partners believe value creation plans fail because management teams lack the required skills. Additionally, the research showed that 80% of talent-centric portfolio companies hit their first-year targets and achieved 2.5 times the return on the initial investment.

Companies that fail to invest in talent face significant consequences. Summit Leadership Partners studies have found that roughly 7.5% of a strategy’s potential value is lost by “failure to have the right resources in the right place at the right time.” Additionally, 92% of PE professionals said waiting too long to act on talent issues resulted in the company underperforming.

Why Do Investors Get Talent Wrong So Often?

Most PE investors are incredibly smart, well-educated and quite successful. Many, however, are not trained and/or experienced in talent and organization science, or underappreciate the role it places in value creation. Furthermore, most deal and operating partners overestimate their prowess in assessing and judging talent. Have you ever heard a PE investor admit they don’t have an eye for talent? The common mistakes investors tend to make include the following:

- They do not translate the value creation plan to critical capabilities and roles

- They over index on previous experience and intuition for hiring decisions

- They undervalued the role talent plays in generating returns

- They viewed the CEO and management team as expendable

- They misread a management teams’ ability to scale

Thus, the need for a professional head of talent/human capital who is critical to the value creation process at PE firms everywhere. PE managing partners and CEOs have come to recognize that the role is required to drive returns because of human capital not despite it. While the value talent executives provide is clear, human capital jobs are different at PE firms. Those in the role must earn their stripes first. Successful talent executives must embrace a broader level of thinking around the business, understand investment strategy, influence investment decision makers and ultimately let go of some of the past tactical, process-oriented and functional tasks.

Increasing Impact and Value – A Typical Path for PE Heads of Talent

In many cases, talent executives are the first of their kind in a private equity firm, although we have started to see movement from one PE firm to another in the past two years. Those who are the first talent executive at their PE firm must help their investment partners understand and embrace new approaches to assessing and addressing talent gaps in their portfolio companies.

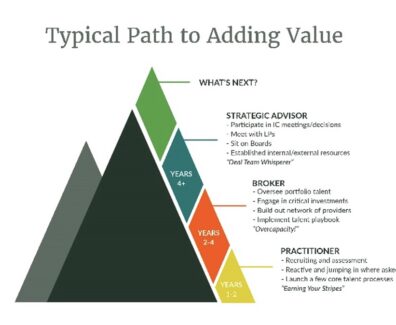

Summit has interviewed numerous talent executives to glean insights into the nature of the job, their ability to positively impact value creation and how individuals in these positions can achieve success in the role. Most grow their role and influence through three phases, from practitioner to broker to advisor. The stair-step process is real, and talent executives must earn respect and credibility.

Earn Credibility as Practitioner. Practitioners are involved in recruiting and assessing human resources, responding reactively and jumping in where asked. Talent executives often spend the first six-to-12 months working closely with operating and portfolio management teams and doing the work, partnering with CEOs, understanding the financial value creation plan, and discovering where to get some quick wins at a portfolio company. They need to develop the financial acumen and influencing skills to communicate with the deal and operating teams. The first instinct should not be to set up process, structure or playbooks. Private equity by DNA is autonomous and entrepreneurial. Those who come in and try to implement processes and programs immediately will likely fail. It is critical to be hands on first.

Brokering your Time. Next comes the broker stage with talent executives overseeing portfolio talent, engaging in critical investments, building a network of providers and implementing the talent playbook. This is the point where the talent head’s bandwidth becomes a concern because they are in such high demand. She will spend time on the most challenging or highest stakes portfolio companies and farm out the other human capital needs to trusted service providers. At this stage, the talent head is highly sought after by the deal and operating team. He or she might be lucky enough to build out a team to handle routine recruiting matters and/or project manage some initiatives. It is critical for the talent head to establish a small network of providers that operates as extension for their talent teams. Within the broker stage, the talent head will continuously evaluate and decide which portfolio talent needs/issues to jump in versus delegate to an outside firm or consultant. The head of talent must stay close enough however to have a point of view on critical issues with deal teams and ensure no surprises when work is performed be a third party,

Becoming a Strategic Advisor. The ultimate stage and goal of most PE heads of talent is becoming a strategic advisor. At this phase, they are seen as essential experts and decision makers at their firms. Ultimately, these talent executives earn the respect and credibility to become strategic advisors, participate in investment meetings, meet with limited partners, sit on boards, and have a voice in portfolio matters. Here the heads of talent are scaling their functions through a blend of expert internal and external resources. They are allocating their own time to advising the deal teams and have a say in investment decisions. They are driving change and adding value to portfolio companies, and investors value their role as strategic advisors. In many organizations, talent executives become known as the ‘deal team whisperer’ because of the insights and guidance they bring. The role is unique and coveted by the ambitious head of talent yet requires a unique combination of investment acumen, talent management expertise, and moxie to stand up to the deal and operating teams.

Because talent executives can jump in and solve problems, the CEO will see the value of their success.

Building Future Success

Because talent executives can jump in and solve problems, the CEO will see the value of their success. When the CEO reaches out and sees them as genuinely adding value, the deal team will too. Wins reverberate across the entire firm, and talent executives will be able to do more. I always advise new PE heads of talent to earn their credibility first by working with a portfolio company CEO and making that person successful. Being hands-on in and in the trenches first will create a ripple effect of the value they can bring to a PE firm.

Even still, human capital in PE is probably one of the loneliest jobs in the world because talent executives are usually the only ones in the firm that does what they do. No one in the firm understands it, and only some of them appreciate it. It is crucial to be self-sufficient, learn and build a network with others in human capital. Several PE human capital forums have formed – formally and informally – for these critical roles to meet, share and learn together. We have organized numerous roundtable dinners to simply have fun and create an outlet for the talent heads to build a sense of community. Every time we host one, the numbers increase. I think it is cathartic for them to get together. There is strength in numbers, and this is an exciting and fast-growing career in PE today. We must evolve and learn to do it together.

Dan Hawkins is the CEO and founder of Summit Leadership Partners. He advises boards, CEOs, investors and business leaders on strategy execution and value creation through leadership and organization performance.