Optimistic Deal-Makers Ready for M&A Activity in 2021

Find out why nearly 75% of deal-makers who responded to a survey conducted by ACG and national advisory firm DHG LLP said they have a positive outlook on M&A.

This story originally appeared in the Winter 2021 print edition of the Middle Market Growth Outlook Special Report. Read the full report in the archive.

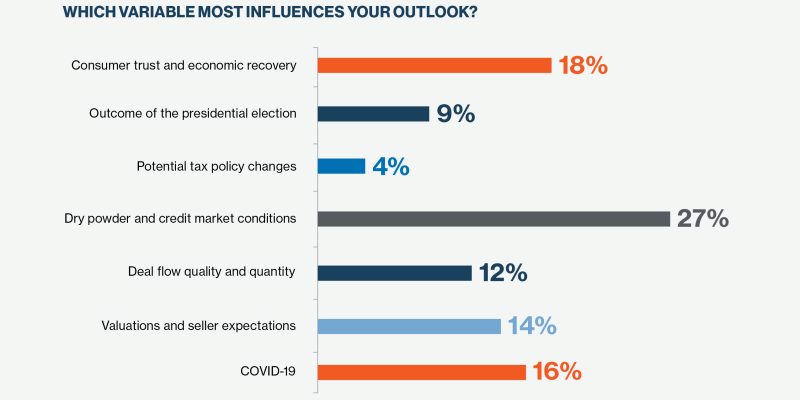

Even with the uncertainty of what’s to come in 2021, private equity professionals are feeling bullish about the year, according to a survey conducted recently by ACG and sponsored by Dixon Hughes Goodman (DHG)1, a national advisory firm. Almost 75% of survey respondents said they had a positive outlook on M&A activity going into 2021. Although their reasoning varied, most respondents pointed to dry powder and favorable credit conditions. Private equity firms have more than $1.7 trillion of dry powder heading into 2021.

“I’m bullish about 2021, especially for companies that performed well through COVID. In 2021, we should have a stable government, improving the COVID situation, including additional government aid and continuing low interest rates,” says Stewart Kohl, co-founder of The Riverside Company. “Business and consumer confidence should be fairly high, and there will be M&A activity. Our macro economic forecast remains a “Nike Swoosh” shape, consistent with a world economy that wants to get better and does so with a steady recovery.”

Deal-makers believe that in addition to favorable credit conditions, other factors will play into increased deal activity. “Another thing that will drive M&A is the aging population. Baby boomers, born post-World War II, are often in positions looking to sell their businesses or assist with management-led leveraged buyouts,” says Brett Hickey, a founder of Star Mountain Capital, a lower middle-market investment firm with private lending, private equity and secondary funds.

Heather Madland, a partner with private equity firm Huron Capital, agrees baby boomers will play a large role going forward. “The baby boomers have lived through three cycles, this pandemic included, and if their businesses have held up or were only slightly impacted by COVID, they are ready to sell. COVID is getting would-be sellers off the bench,” she says, adding that Huron has six companies under letter of intent that are pushing to close so as not to risk further impact.

M&A deal activity had rebounded from the first and second quarter and most expect this trend to continue going into 2021. Deal activity in Q3 surged to 2,714 deals for a total deal value of $361.1 billion, notching quarter-over-quarter gains of 23.5% and 7%, respectively, according to Pitchbook Data. This bodes well for 2021.

Our macro economic forecast remains a ‘Nike swoosh’ shape, consistent with a world economy that wants to get better and does so with a steady recovery.

Stewart Kohl

Co-Founder, The Riverside Company

Additionally, while this survey was conducted prior to the U.S. presidential election, most respondents expected the outcome to have very little impact on M&A activity. In fact, more than 65% of respondents said a Biden win would lead to more M&A activity or have no change to M&A activity. Only about 30% of respondents felt a Biden win would lead to less M&A activity.

Graeme Frazier, a partner with Private Capital Research, a buy-side investment and M&A firm, agrees that dry power will play a strong role in the M&A market in 2021 and that the election won’t change that. “I have a positive outlook for private equity and M&A activity regardless of the election. The amount of investable capital out there is a gigantic catalyst that is not going away. The scarce resource is the number of deal opportunities that are worthy of institutional private equity capital,” he says.

Steven Frank, a partner with DHG Transaction Advisory, also expects deal activity to continue to be strong and to see an increase in deal flow. “Many of our clients and investment bankers are noting a significant percentage of current deals stem from sellers trying to preempt an expected rise in taxes as they anticipate capital gains will soon be treated as ordinary income. Given discussions with our private equity clients and the variety of trends we are seeing, we anticipate deal volumes returning to, or near, pre-COVID levels at some point in 2021,” says Frank.

In terms of deal flow, respondents overwhelmingly believe that add-on acquisitions will be the most common type of deal that gets completed. More than 60% said they expect add-ons to take center stage. This builds on what was already a strong trend for the past couple of years, including in 2020. With the onset of COVID-19, many private equity firms turned to add-on acquisitions to put capital to work with less risk involved. Add-on deals are often smaller than platform buyouts, and allow private equity firms to grow their portfolio companies via inorganic growth. These smaller companies are less likely to be institutionally backed, unlike platform companies, and are more likely to be struggling from COVID-19-related effects, making them especially attractive to private equity firms. Thus, it is no surprise that add-on deals made up 73.4% of private equity buyouts in Q3 2020, the highest number on record, according to Pitchbook.

Huron Capital closed 15 add-ons through the first three quarters of 2020—13 since April 1—and Madland expects this trend to continue for private equity in general, as well as at her firm. “It’s potentially easier to underwrite an add-on, as you are already seeing the impact of COVID on the platform company and can leverage what you know about how that specific industry is responding to COVID,” she says. “Overall, I believe buy and build will continue to be a critical aspect of our growth strategy going forward, perhaps especially now.”

Huron Capital closed 15 add-ons through the first three quarters of 2020—13 since April 1—and Madland expects this trend to continue for private equity in general, as well as at her firm. “It’s potentially easier to underwrite an add-on, as you are already seeing the impact of COVID on the platform company and can leverage what you know about how that specific industry is responding to COVID,” she says. “Overall, I believe buy and build will continue to be a critical aspect of our growth strategy going forward, perhaps especially now.”

Deal-making in most of 2020 was largely driven by smaller transactions. During the first three quarters of the year, deals under $100 million accounted for 68.7% of all M&A activity—the highest level since 2016. Deals in the $1 billion to $5 billion range made up only 1.2% of the deal count, which is the lowest percentage for this size category since 2013, according to Pitchbook. The pandemic has led deal seekers to scour the lower middle market for returns that may have been overlooked by other acquirers who have been priced out of the middle market, according to Pitchbook.

“You can often get better value from lower valuation add-on acquisitions in the lower middle market, which is a big driver of deal demand. Roll-ups can be a good way to increase EBITDA valuation multiples as companies grow into more competitive and higher valued market segments,” Hickey says. “It’s a strategy we also use. There are many smaller, high-quality businesses that don’t want to go through the grind of another recession.”

He points out that one-third of the U.S. population is around or over 60 years old. Business owners may be willing to accept a lower price in order to reclaim free time as they age, opening the door for prospective buyers. “These types of businesses can make great add-on acquisition opportunities, where the sellers also want to retain a more passive role and remaining economic interest, and therefore alignment of interest with us as the investors,” Hickey says.

Industries to Watch

Asked about their expectations for the types of companies coming to market in 2021, most folks, 64%, said they anticipate medium-quality opportunities, while 29% of respondents expect there to be high-quality deals available. More than 60% of respondents expect to actively pursue an acquisition within the next 12 months.

For her part, Madland reports seeing a disproportionate number of higher quality assets coming to market. “Since we tend to invest in generally healthy, profitable and growing companies, much of the more actionable deal flow we are seeing is COVID-resilient or has been minimally impacted by COVID,” she says. “With lots of equity capital eager to be deployed and continued ready access to credit and leverage, valuations are holding up and, in some cases, rival the pre-COVID valuations we were seeing.”

Perhaps not surprisingly, when asked which sectors deal-makers expect to focus on in 2021, responses were all over the map. Some of the hotter sectors include business services, consumer products and services, health care and pharmaceuticals, and technology—all sectors that have become increasingly important since the spread of COVID. Madland expects industrials and utilities to be of interest, too. “Businesses that provide critical infrastructure or critical systems maintenance and repair can be very attractive, given their resiliency to swings in economic activity. Also, businesses that provide products or services to warehouses— or play at all in the logistics space, particularly as it relates to grocery— can be appealing, too,” she says.

Logistics and transportation is an industry that’s also expected to garner interest. “There are a lot of products being moved around as people are having more delivered to their homes,” Hickey says. “They are also buying more products for home use, like educational products to help their kids with education, exercise equipment or consumer electronics. I think we will continue to see an uptick with things being delivered.”

Industries that will likely receive less attention in 2021, according to survey respondents, include automotive, entertainment and retail.

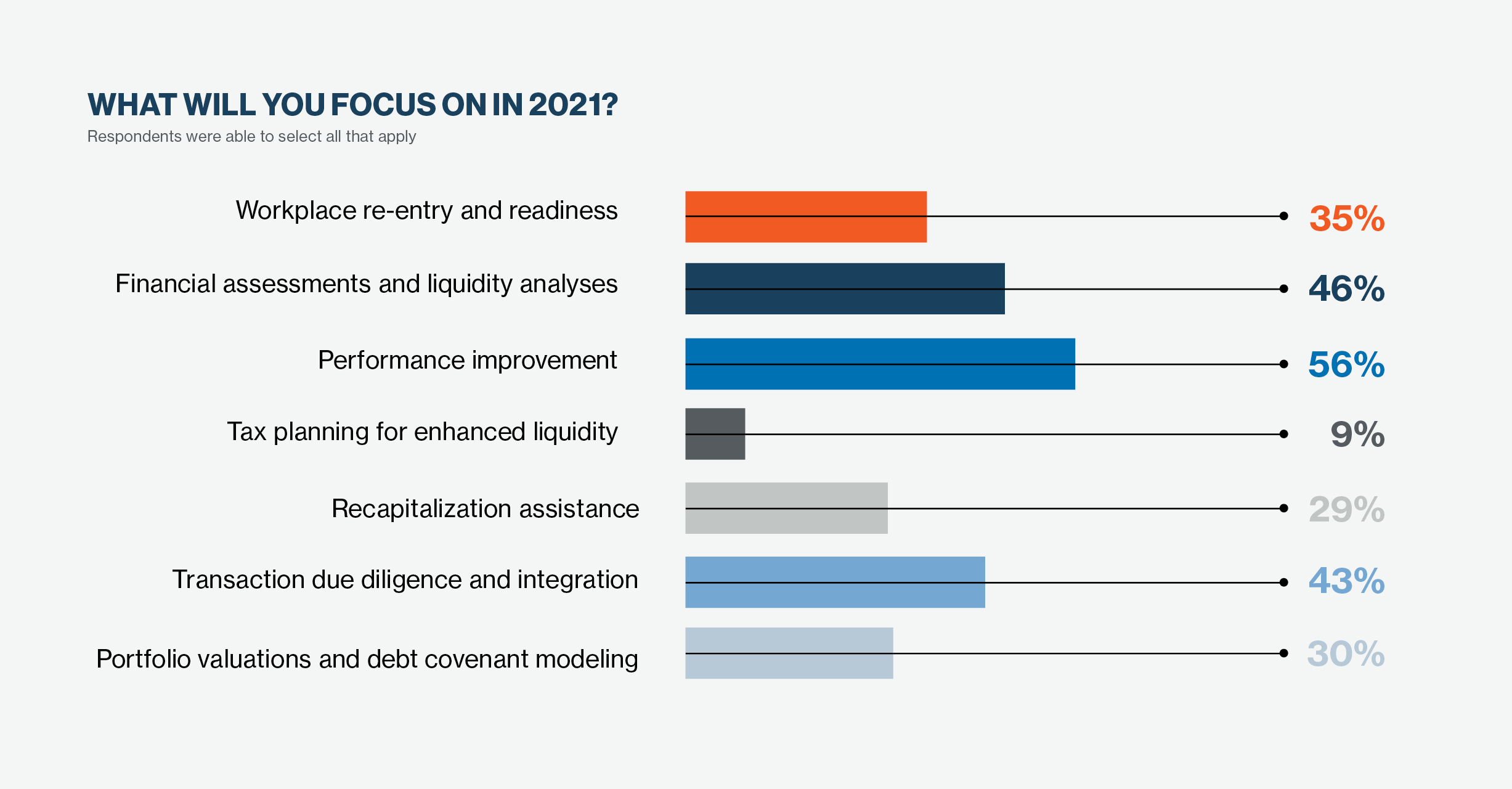

As far as working with portfolio companies, most deal-makers believe their time will be spent working on performance improvement, workplace re-entry and readiness, financial assessments and liquidity analyses. Scott Linch, a managing partner of DHG Private Equity, says performance improvement is key to enhancing EBITDA and unlocking sources of cash flow. “For many businesses, COVID-19 has illuminated the need to remaster the basics of performance improvement in a world that demands extraordinary agility and adaptability,” Linch says.

Individual businesses will have different needs in the coming year, says Private Capital Research’s Frazier, and private equity approaches to portfolio management vary. “Every company and portfolio is situational. No one wants to admit how much time they are putting into managing the portfolio. Some firms have teams dedicated to that, others don’t,” he says.

One thing to expect from all private equity investors in 2021 is a focus on identifying high-quality, well-priced businesses. “In addition to the things survey respondents mentioned, I think deal flow will be a priority for everyone,” Frazier says. You have to find companies to invest in that are worthy and where you don’t have to pay crazy multiples.”

1 Between September 8 and November 3, ACG surveyed deal-makers about their outlook for 2021 and other topics. More than 600 people responded to the ACG surveys.