The New Decade Calls for Greater Firm Diversity

Want to attract the best talent, draw investors and yield greater returns? Diversity can help you achieve those goals.

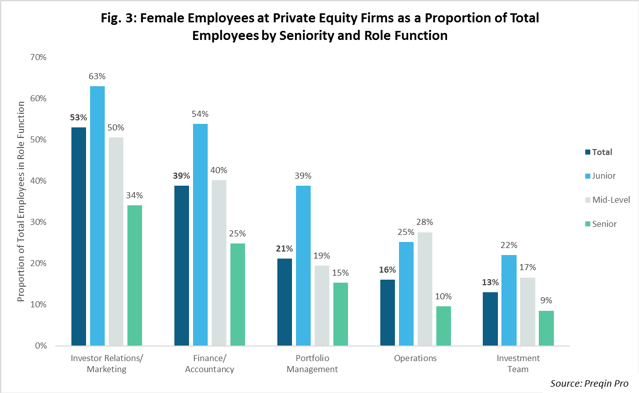

Although gender diversity has come into focus within private equity over the last decade, female investment professionals continue to make up only a small share of the industry’s workforce. The stats are even worse when it comes to women-owned emerging managers.

The industry’s continued spotlight on gender diversity is important and necessary, but its lens should be wider. Often simplified to gender, “diversity” includes race, religion, ethnicity, education, age, sexuality, geography, socioeconomic background and more.

Private equity is by no means unique in struggling with increasing diversity in its ranks. The global diversity and inclusion industry is worth billions of dollars, yet it has failed to move the needle in a meaningful way.

Progress has been inhibited by one overwhelming factor: Organizations bring diversity into work cultures that are unprepared for it.

Policies and processes often remain unchanged, and workplace protocols and norms stay the same. The expectation is that any person outside the majority must “fit in.” Diverse individuals are often subject to microaggressions and microinvalidations, such as jokes, comments or exclusionary acts that can marginalize such individuals even when no harm is intended.

These subtle and not-so-subtle slights take an emotional toll, negatively impact productivity and often lead diverse employees to move on. In a survey of private equity professionals, 50% of women said they would consider leaving the industry, compared with just 22% of men.

What’s the Problem?

Without a growing number of women and other diverse investment professionals hired, retained or promoted to senior positions at firms, the path to more diverse general partners and emerging managers is narrow. However, the call for diversity does not mean diversity for the sake of diversity.

For this article, I spoke with more than two dozen industry participants, including private equity GPs, institutional LPs, fund of funds, placement agents, consultants and industry recruiters. Nearly everyone I spoke with indicated that while the goal is to achieve a diverse slate of candidates, the most qualified person ultimately gets the job. (The diversity candidate wins if all else is equal.)

Diversity and superior financial returns are not mutually exclusive. Investors with diverse teams all cited the benefits of having different perspectives during collaboration and decision making. (Conversely, a major risk of no diversity is group-think.)

Research has piled up demonstrating the clear monetary benefits of diversity. Most recently, a study conducted by The Wall Street Journal looked at S&P 500 companies and another, published by Parisian business school HEC, underscored the economic benefits of gender diversity at PE firms. The National Association of Investment Companies—a network of diverse-owned and emerging manager private equity firms and hedge funds—has reported that firms with diverse ownership and more diverse teams dependably outperform the Cambridge Median Quartile, a private investment benchmark, over long time horizons.

The data is clear: Diverse teams generate better decisions and superior results, including in private equity. Carlyle Group’s leadership grasped that link nearly a decade ago, as Chief Diversity Officer Kara Helander explained: “Carlyle is fundamentally in the business of making really good decisions. There is a high level of buy-in from senior leadership and across the firm that diverse teams make better decisions. We have been intentional about building and retaining a diverse workforce and it is an important element of our firm’s business strategy and culture.”

Change Is on the Horizon

Though not immediate, there are multiple dynamics that are likely to make the 2020s the “Decade of Diversity” in private equity, including changing demographics, demand from limited partners, more women helping other women, and growth in the number of diverse managers.

Changing demographics: Change is coming on several fronts. Most significant, the millennials are about to take over. By 2030, all baby boomers will be age 65 or older and most firms will be led by members of Gen X and millennials, the youngest of whom will be in their mid-30s. As a generation, millennials are known for more progressive ideas on diversity and inclusive cultures and are positioned to lead according to their values.

“We have been intentional about building and retaining a diverse workforce and it is an important element of our firm’s business strategy and culture.”

Kara Helander

Chief Diversity Officer, The Carlyle Group

Change in the U.S. population will extend beyond age. Generation Z is the most racially and ethnically diverse generation in history. Its members are expected to make up roughly 30% of the working population in 10 years, and they’ve expressed strong interest in working for diverse organizations. Firms will need to respond to that demand or risk missing out on the best talent.

More diverse college and MBA graduates will also contribute to workplace diversity. Women are on the brink of becoming the majority of the college-educated workforce and continue to outpace men in achieving that level of education. They now make up 47% of MBA graduates from U.S. business schools, up from 5% in 1970, and the current percentage is expected to climb higher. MBA programs are increasingly focused on recruiting and retaining both women and minorities.

LP demand: Another tailwind for diversity within private equity firms is increasing pressure from limited partners. GPs that have raised funds over the last few years told me that questions about firm diversity are coming almost exclusively from public pension funds and select endowments. Among those on the forefront is New York City’s public pension fund, the fourth largest in the U.S., which actively uses a diversity questionnaire.

The Riverside Company Chief Operating Officer and Vice Chairman of Strategic Initiatives Pam Hendrickson suggested diversity can be an important differentiator during fundraising. “At public pension funds, increasingly if there is a tie on returns, absolutely the firm with diversity is most likely to win the tie,” she said. For this diversity driver to really take hold, more LPs need to start asking robust questions, incorporate diversity-scoring in analysis, and enforce accountability and next-fund ramifications. As one person I spoke with said, “LPs have the power to push it”—but it can’t be all bark and no bite.

More women helping other women: The senior GP women I interviewed spoke of male sponsors who supported them as they rose through the ranks and their individual efforts to encourage and coach women aspiring to join or advance in the business. One of them, Norwest Venture Partners General Partner Sonya Brown, offers specific advice for women considering joining an all-male firm: “Find the partner with three daughters. He will be your champion.”

“When we started avante, we thought diversity was important, but it was not the mission. Over time, it became the mission and a point of differentiation with investors, sponsors and management teams.”

Jeri Harman

Founder and Chairman, Avante Capital Partners

Increased networking and dealmaking opportunities for women will be facilitated by women’s groups, such as those organized by the Association for Corporate Growth, the Private Equity Women Investor Network and the Women’s Association of Venture & Equity, and events like the Annual Women’s Private Equity Summit and ACG New York’s Annual Women of Leadership Summit. Meanwhile, the pipeline of potential private equity professionals will continue to grow through groups like Girls Who Invest.

Growth in the number of diverse managers: Diverse leadership has been shown to yield greater diversity throughout the rest of the firm. The National Association of Investment Companies—whose members are diverse-owned—reports that 58% of member firms’ investment professionals are women or minorities, compared with 42% for non-members.

Only a limited number of public pensions and other LP investors currently have clearly defined and organized diversity and emerging manager initiatives, but there are encouraging signs of greater focus on increasing the number of diverse managers and a growing commitment by foundations. As demographic trends advance over this decade, institutional investors will face increasing pressure to develop such programs to reflect constituent diversity.

Why Now in the Middle Market?

The middle-market “first movers” I interviewed view diversity in their firms as a differentiator and competitive advantage.

Avante Capital Partners is among them. Founder and Chairman Jeri Harman told me, “When we started Avante, we thought diversity was important, but it was not the mission. Over time, it became the mission and a point of differentiation with investors, sponsors and management teams.”

The middle market, intensely focused on returns and attracting investors, is mature and competitive, and the war for the best talent is real. Don’t risk falling behind. Make 2020 the year you start—or double-down on—building a diverse investment team and more inclusive culture.

Read the second installment of our two-part series on diversity and inclusion: “Creating an Inclusive Firm Culture.”

Elise Chowdhry, MBA and SHRM-SCP, is the managing principal of Optimum Advisors LLC, a management consulting firm focused exclusively on helping middle-market firms and companies optimize leadership and team potential, create high-performance cultures and achieve organizational goals.