Economic Growth is Running Out of Steam, RSM Data Shows

Despite some positive indicators, mounting geopolitical risks could drag the U.S. economy to near-recessionary levels in coming months, writes RSM US Chief Economist Joseph Brusuelas.

This article is sponsored by RSM US LLP. It was originally published on RSM’s The Real Economy Blog on Sept. 26.

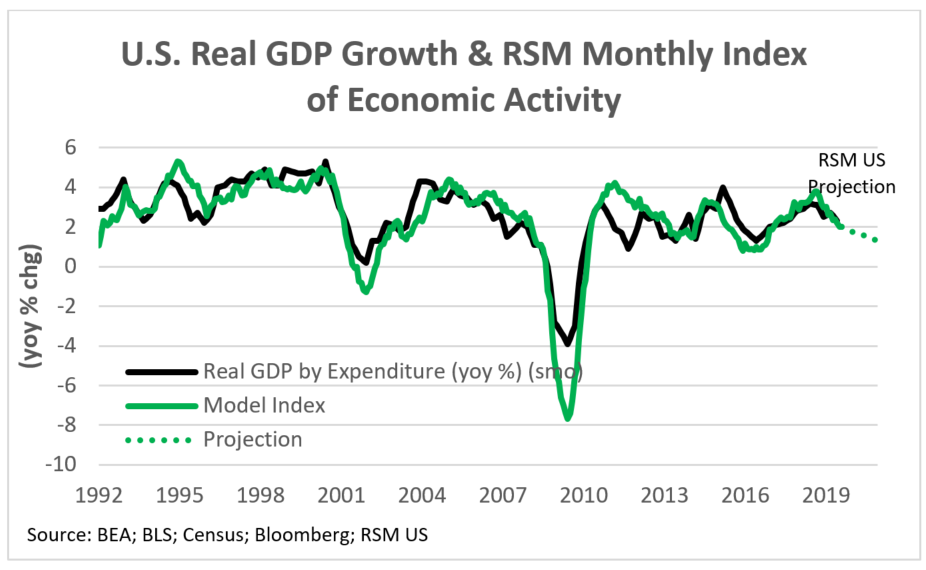

The U.S. economy likely grew at a 2.0% yearly rate in July and August, a drop from the 2.3% yearly rate of U.S. real GDP growth in the first quarter, according to the RSM US Real GDP Index (see chart below). (The index is based on a subset of indicators used by the National Bureau of Economic Research.)

So far the domestic economy has absorbed two policy-induced shocks—a trade war with China and the slowing of immigration—and one exogenous oil supply shock, all contributing to the story of slower growth. Once the economy slows to near 1% next year, recession risks will become elevated.

Our longer-term projection is for growth to continue to decline in the months and quarters ahead, as the U.S. economy runs out of steam at the end of a decade-long business-cycle upswing and the trade war exacerbates the global economic slowdown.

Our projections of slowing growth in 2019-2020 correspond with forecasts from the UCLA Anderson School of Management, which call for 2.1% yearly growth in the fourth quarter of 2019, falling to 1.2% in 2020. The September UCLA Anderson Forecast cites “a global economy in flux, taking into account the U.S. trade war with China, President Trump’s criticism of Federal Reserve Chair Jerome Powell, near-recessionary conditions in Europe, Brexit, slowing economies in Brazil and Mexico, and all manner of rising geopolitical tensions.” Despite these factors, the forecast remains in positive territory.

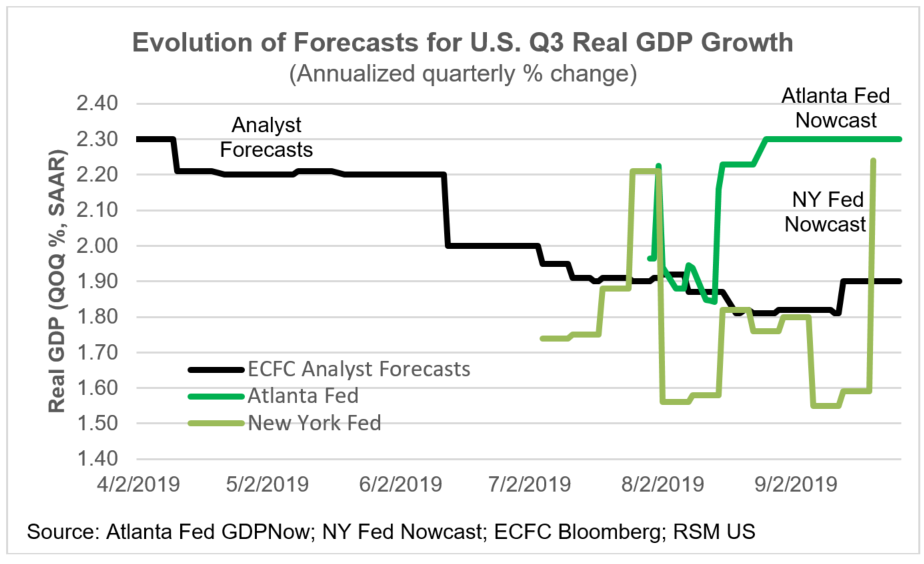

The latest estimates for annualized quarterly growth in third quarter range from 1.9% — from a survey of economic analysts by Bloomberg — to 2.3% from GDPNow forecasts from the Atlanta and New York Federal Reserve banks (see chart below). Note that these so-called “nowcasts” are based on the release of economic data as it becomes available during the quarter and will therefore fluctuate over the course of the quarter.

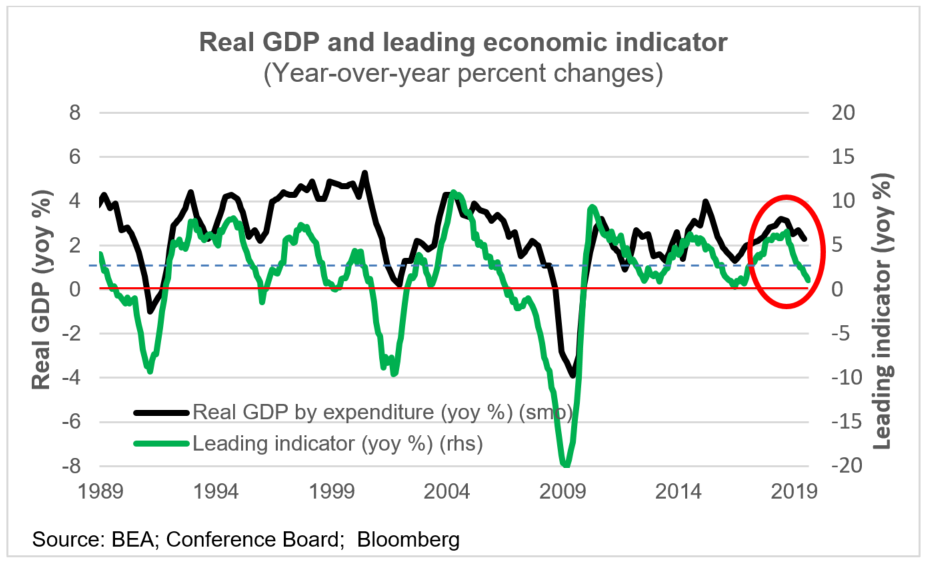

The Conference Board Leading Economic Index is also implying a slowdown. The indicator was flat in August (see chart below), with the CB noting that recent trends are “consistent with a slow but still expanding economy, which has been primarily driven by strong consumer spending and robust job growth.”

Recall that the CB’s composite leading indicator is designed to identify turning points in the economy by aggregating trends in monthly economic data and high-frequency financial data. It has nevertheless been decelerating since November 2018 – a nearly year-long decline that is cause for concern.

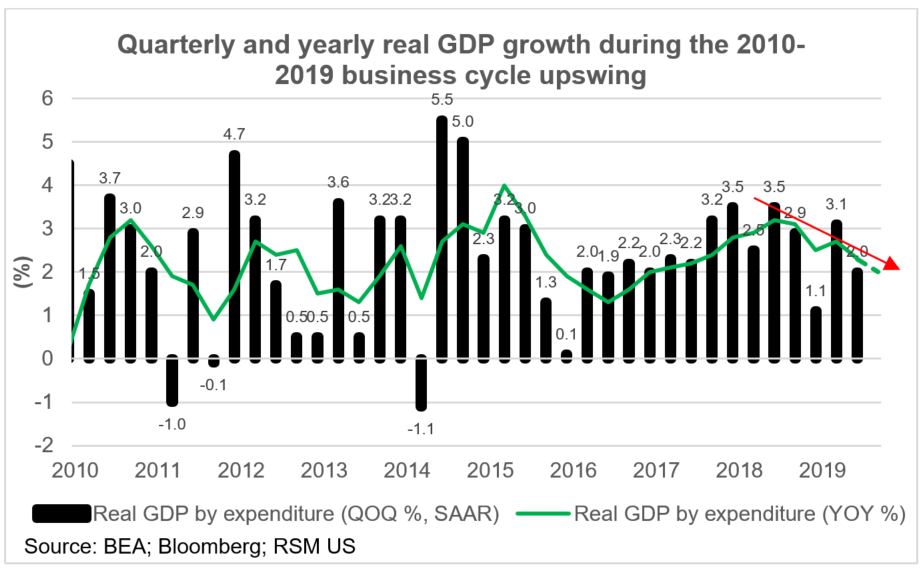

So while the consensus among forecasts and projections is that the decade-long expansion might indeed be stretched and that we should not expect a return to 3% growth—given economic and geopolitical turmoil and uncertainty brought on by domestic and foreign events—there is not yet a call for the end of that expansion based on current data. Instead, the consensus is for the economy to muddle along in the absence of a shock (see chart below). Furthermore, slipping into 1% growth sets the stage for one of those economic or geopolitical events to push the global economy into a full-blown recession.

What accounts for all the muddling?

Personal consumption expenditure

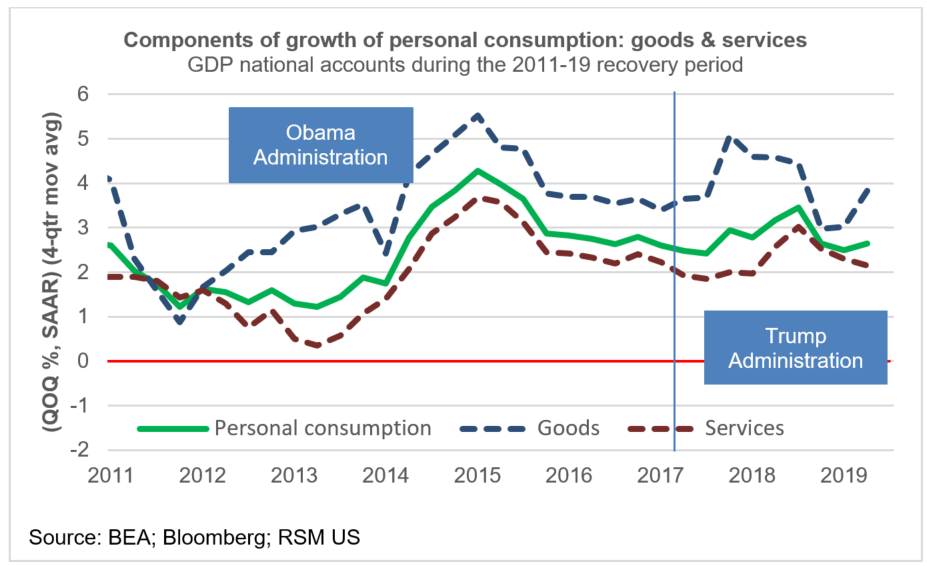

While manufacturing is undeniably in decline among the major economies, the U.S. labor force is at full employment, interest rates are extraordinarily low and consumer spending remains robust (see chart below). The labor market tends to lag changes in the business cycle, however, and when unemployment is at its lowest point, wages would be expected to rise as businesses compete for a diminishing pool of labor. Therefore, unless prices were to suddenly spike higher due to external events, we expect personal consumption to support overall economic growth.

Diminished Trade

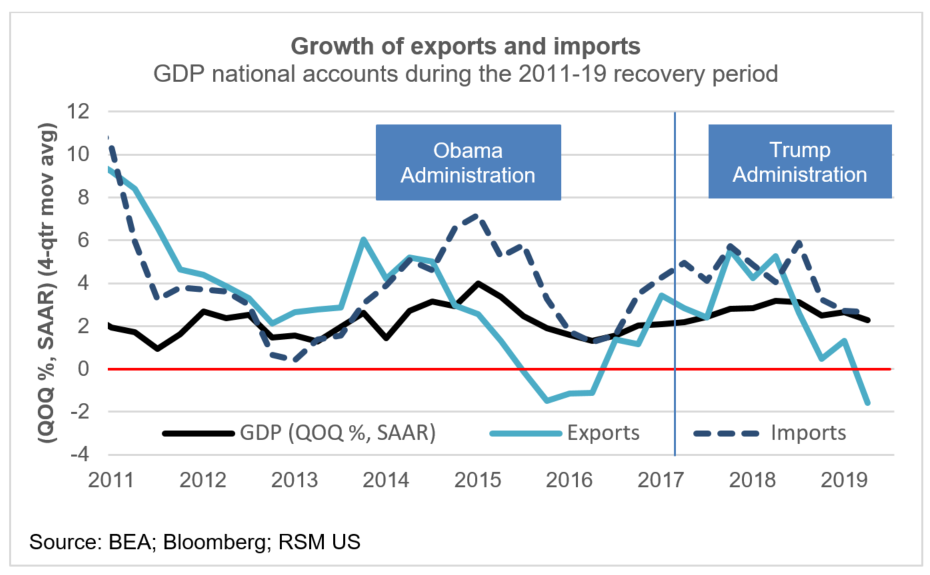

On the negative end of the spectrum, the indirect costs of the trade war remain the most visible factor holding the economy back. Tariffs implemented in the first half of 2018 have resulted in disruptions and diversions in the global supply chain, uncertainty for businesses and investors, and finally, retaliatory reduction in purchases of U.S. goods by China. The next blow could come from rising energy costs, if Middle East tensions escalate and limit the flow of oil to Asia.

As shown in the following chart, growth of U.S. exports has diminished since the tariffs were implemented in early 2018, and became negative in the second quarter of 2019. Import growth has diminished as well, which only adds to the global slowdown.

Diminished investment

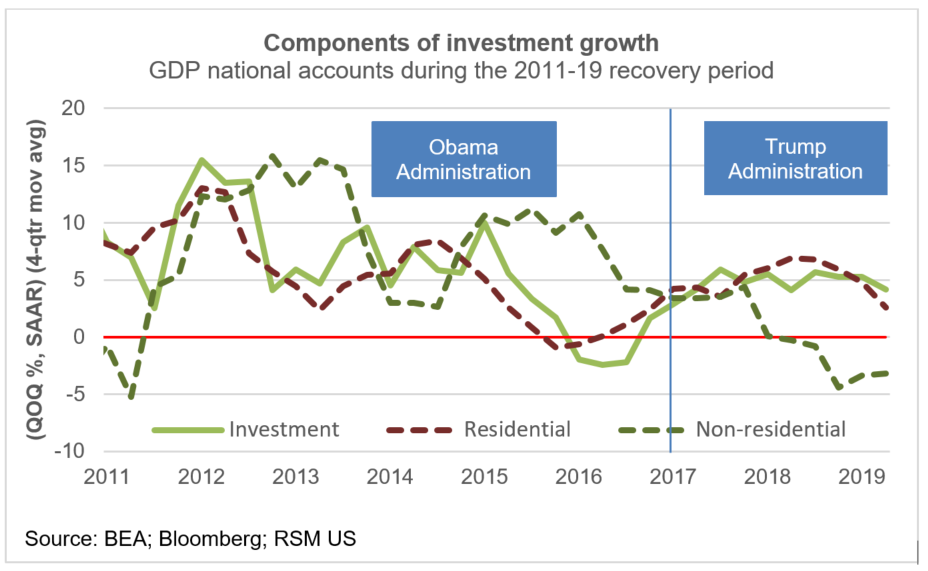

Uncertainty would be expected at the end of a business cycle, and with it a reluctance to invest. Indeed, non-residential investment did not respond to the 2017-2018 federal tax cuts, but instead continued to decelerate and finally turned negative throughout 2018-2019 (see chart below). Given the economic and geopolitical uncertainty and the lack of a fiscal response to the global economic slowdown, the likelihood of an increase in investment seems diminished as well.

Note that residential investment began to decelerate in the second half of 2018, likely due to the Federal Reserve’s interest-rate normalization program.

Joseph Brusuelas provides macroeconomic perspective to help RSM clients anticipate and address the unique issues and challenges facing their businesses and the industries in which they operate. In 2015, he helped launch The Real Economy, the only monthly economic report focused on the middle market, and helps lead the firm’s cutting-edge Industry Eminence Program.