Unwavering Optimism: Dealmakers Say the M&A Tide Is Finally Turning

The M&A market failed to live up to expectations in 2024, but dealmakers are confident that the tide is finally turning

The private equity industry is experiencing déjà vu. When the curtain began to close on the 2024 calendar year and M&A industry experts kicked off the triedand- true practice of prognosticating about the year ahead, there was an overwhelming sense of familiarity— predictions virtually identical to those made at the end of 2023. Though there are minor differences in what individual managers and investors expect from the marketplace in the coming months, dealmakers and advisors agree that everyone is still waiting for the surge of deal activity that was expected in 2024.

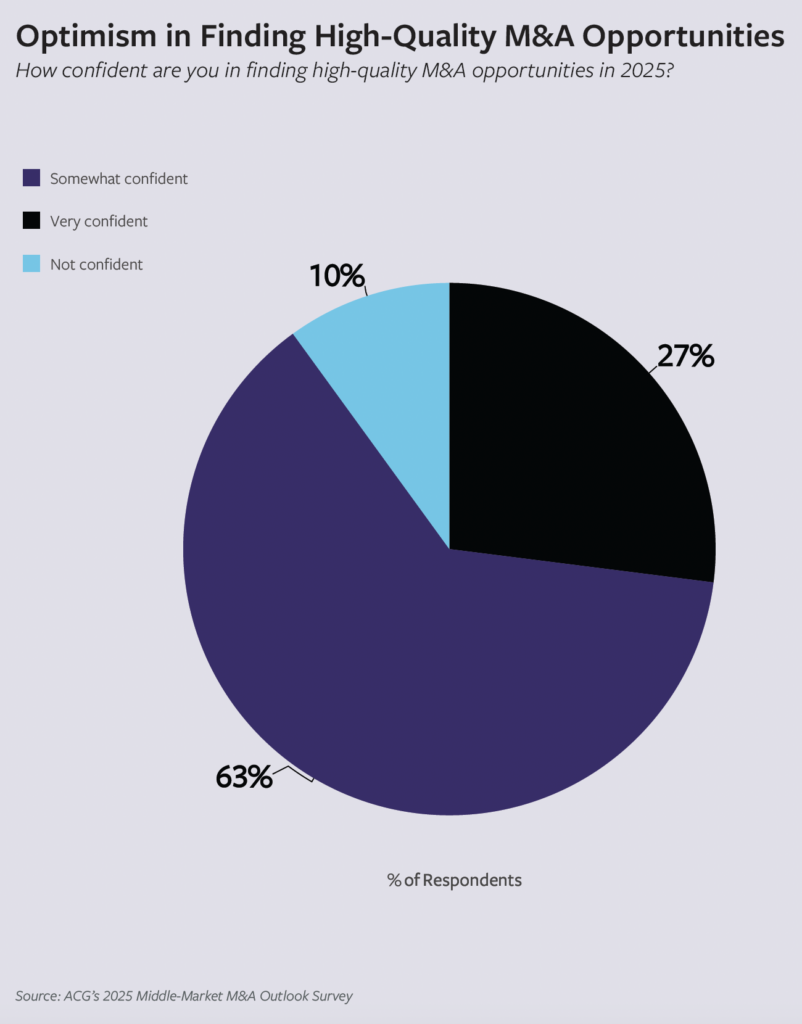

Once again, industry professionals are looking ahead with a sense of optimism that the proverbial floodgates will finally open, and there is a staunch belief that this time those expectations will come to pass. Nonetheless, they are hedging their predictions a bit, and there has been a slight tapering of the volume of deals expected.

This section of the report is sponsored by S&P Global Market Intelligence and originally appeared in the Middle Market Growth 2025 Outlook Report.

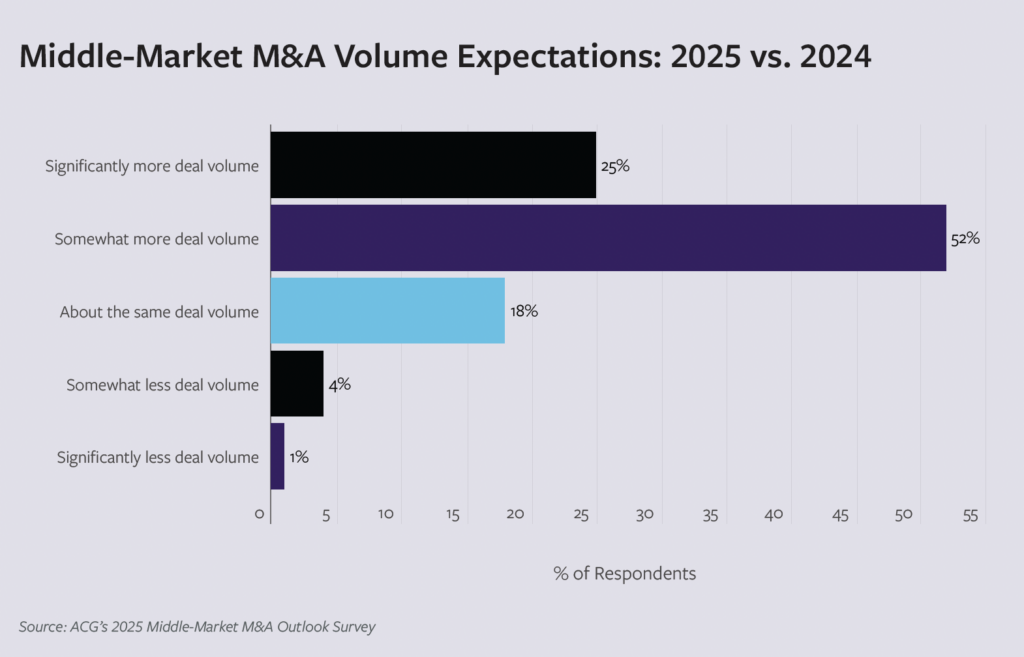

Based on a survey of the ACG community, 52% of respondents expect to see somewhat more deal volume this year compared with 2024. Only 25% anticipate a significant increase in deal volume, and 18% expect deal volume to remain largely the same. Merely 5% of respondents expect to see deal volume decline. Comparatively, at the end of 2023—a year plagued by minimal deal activity—55% of respondents predicted an increase in deal activity in 2024, 27% expected activity to remain largely the same as 2023, and 18% anticipated a decline.

While Phil Connors, the character played by Bill Murray in the movie “Groundhog Day,” had to relive a single day at least 38 times before escaping the time loop, private equity industry experts doubt that 2025 will see a repeat of the lackluster deal activity that plagued the market over the past couple of years. Industry experts expect recent developments to help spur an uptick in M&A. They include reduced political uncertainty following the U.S. presidential election, rate cuts from the Federal Reserve, an overall increase in the quality of companies coming to market, waning patience among limited partners who want capital returned and the arrival of more realistic valuation expectations. By the fourth quarter of 2024, there were already signs that deal activity was starting to pick up.

“At the beginning of [last]year, there was an expectation that there was going to be a very robust M&A market throughout 2024, but that wave did not come to fruition in a way that a lot of people had hoped,” says Chris Sheaffer, a partner at Reed Smith, speaking in late October. “But we have seen a significant uptick in deal activity, especially in the middle market and lower middle market, particularly the number of sell-side engagements that we’re seeing.”

Quality and Quantity

Though middle-market M&A activity has been slow, PE firms have not just been sitting on the sidelines. They have been actively working with portfolio companies to boost value. “Many companies have grown over the last several years into valuations that may have been, quite frankly, ahead of their skis during the era of free money. However, we’ll likely see the M&A landscape gain momentum in 2025 as these companies demonstrate growth in the underlying business and with an improving exit environment driven by interest rates coming down and a friendlier regulatory landscape,” says Chris Sugden, a managing partner at Edison Partners and chairman of the firm’s investment committee.

Adds Whit Matthews, a managing director at HighVista Strategies: “Our GP partners and our management teams have grappled with ongoing challenges, including interest rates, inflation and supply chain issues, and have gotten their businesses to a better spot, where they’ve been able to rationalize cash flows and costs.”

Ken Gavrity, head of commercial banking at KeyBank, notes, “It’s a matter of the haves—the folks who really got the business model correct—versus the have-nots and the people who are still struggling in this environment. … Many middle-market companies adapted and got very fit over the past couple of years. They’ve gotten their operations lean and have had to ensure that they were able to adjust to inflation.” Still, the assets coming to market remain a mixed bag.

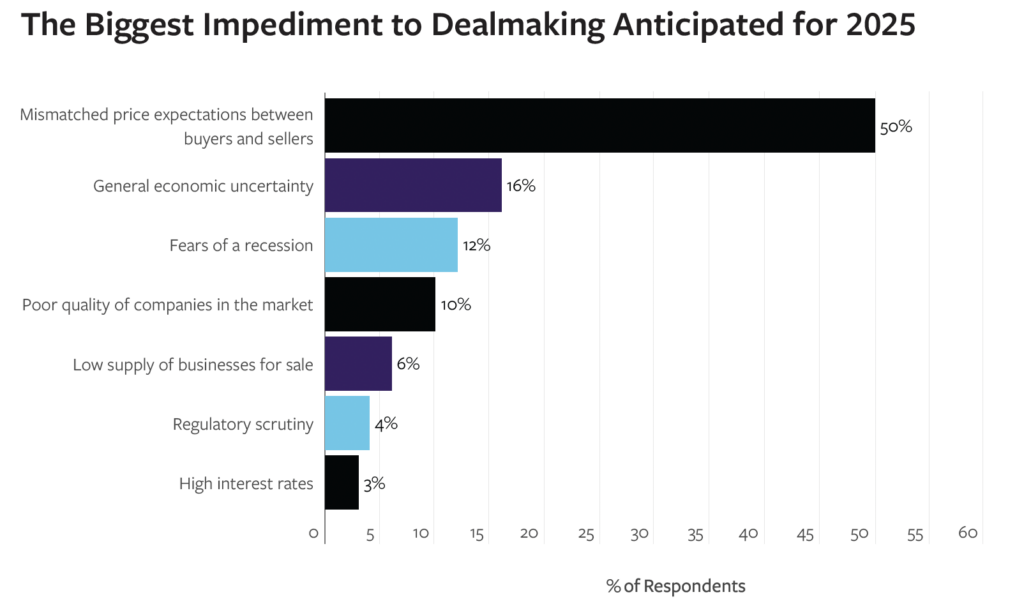

“People are seeing the same deals come around to them multiple times. So, when a quality deal does come through, there are very competitive situations around those deals,” says Eric Moskowitz, a partner with law firm Morrison Cohen. Adds Reed Smith’s Sheaffer: “It begs the question, given the large number of firms that are chasing quality deals, why more haven’t come at this point.” Industry experts point to familiar issues, like lingering high interest rates and mismatched valuation expectations, for keeping M&A at bay.

“In 2021 there were a number of companies purchased at pretty high multiples, but that’s very hard to justify given very little growth over the last couple of years,” says Patrick Turner, a managing director at VSS Capital Partners, which focuses largely on the lower middle market. “Cost levels are too high for larger buyouts, and there is still a gap between expectations, valuations and the offers that are actually being put forward.” In fact, industry experts believe that a significant pickup in middle-market M&A will be somewhat contingent on the volume of larger deals ramping up first and leading to a trickle-down effect.

Though sellers have become somewhat more realistic about valuations, there is still a notable divide between what sellers want and what buyers are willing to pay. “I don’t think that valuations have come down as much as we’d expect, and I think that the lack of deal activity is really the result of the fact that people are still holding on to these notions of value,” says Moskowitz, noting that deal consistency is unlikely to materialize until valuations come down further. The valuation spread for companies with attractive pricing characteristics versus the market as a whole narrowed to 0.2x–7.3x, compared to 7.1x, according to data for Q2 2024 from GF Data, which noted that favorable pricing had virtually no impact on valuations during that period. GF Data attributes this to “overall depressed valuations in the middle market and the B properties that made up a significant proportion of transactions in the first half of the year.”

Source: ACG’s 2025 Middle-Market M&A Outlook Survey

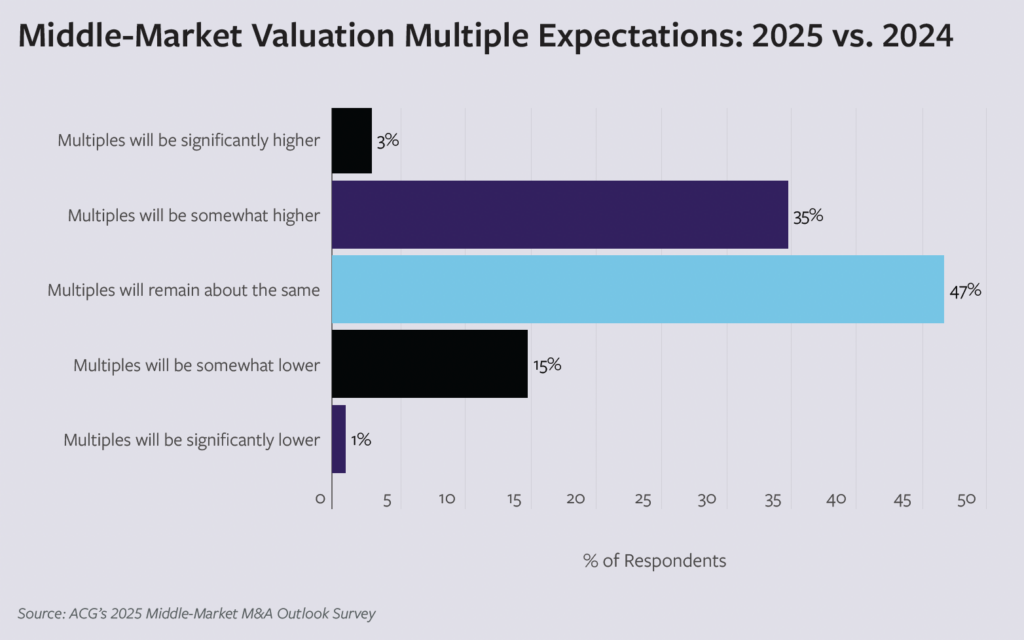

When asked about expectations for valuation multiples in 2025, 47% of respondents to ACG’s survey said they expect multiples will remain roughly the same, 35% believe they will be somewhat higher, and 3% expect them to be significantly higher. Meanwhile, 15% anticipate multiples will be somewhat lower than in 2024, but only 1% of respondents expect them to be significantly lower.

Strategic and PE Competition

One area where experts say M&A activity in the middle market has already begun to pick up is strategic acquisitions. “Over the past year, strategics made a comeback. When PE buyers were largely sitting out, strategics came in and said, ‘Hey, we’re a strong company with a balance sheet, so let’s buy a competitor.’ Where they may have previously lost in a bidding war, now they are actually succeeding,” says Mike Okaty, a partner at law firm Foley & Lardner. He adds that, throughout the course of the past few years, the M&A market shifted from a seller’s market to a buyer’s market and is once again creeping back toward a seller’s market. “Of almost 30,000 portfolio companies, over half of them are four- or five-year vintages, meaning there is a maturity event coming up where PE firms need to become sellers,” he says.

While many PE firms remain unwilling to let investments go at bargain basement prices, pressure from LPs to return capital for reinvestment has begun to force the hand of many fund managers.

According to data from MSCI, global PE firms still hold close to $2 trillion in dry powder that they have been unable to put to work over the past couple of years. Despite the slow M&A environment, countless funds continued fundraising throughout 2024. As LPs lose patience with fund managers for collecting management fees on money that has yet to be deployed, there is increasing pressure to put dry powder to work. Industry experts predict that there will finally be a break in the cycle in 2025.

Meanwhile, industry professionals say that distressed fire sales began to pop up over the past year, as owners decided they are finally ready to cut bait and move on. At the same time, with many of these companies having thrived during the M&A downturn, another theory is that some of these entities could ultimately manage attractive exits, thanks to an increasing appetite among investors for viable deals. In many cases, instead of fire sales, companies have been shedding noncore assets. Investment firms increasingly have turned to continuation vehicles and dividend recaps to return at least some capital to LPs.

Pockets of Opportunity

Although M&A activity in 2024 failed to live up to expectations, investors have continued to find value in specific sectors. As the baby boomer generation ages, healthcare remains a particularly appealing sector within PE, as do industrials, energy and financial services, all of which have seen significant interest. According to data from Leerink Partners, M&A activity within the healthcare sector was up 6% in the third quarter of 2024 and 57% year-over-year. M&A activity within the healthcare sector represented 42% of total deal volume, with 33 transactions valued at $32 billion, compared with 21 transactions during the same period in 2023.

Experts say they’re seeing more activity in blue-collar sectors as well. “The focus of private equity continues to evolve from traditional manufacturing and distribution assets across durable and nondurable goods into more blue-collar commercial, residential and industrial services-related businesses. Once a platform investment is made, firms are able to leverage the benefits of scale to professionalize add-ons, realize immediate synergies and improve returns. This is a playbook that has proven successful across a variety of verticals ranging from HVAC, plumbing, electrical and roofing to automotive services, collision repair and car washes,” says Nick DeCroo, a director and founding member of Woodward Park Partners. “These industries tend to be highly fragmented and ripe for consolidation. It takes a lot of work, but there’s profit to be made there.”

Absent a strong supply of large-cap deals, a sizable portion of the deal activity in 2024 involved smaller transactions—a trend industry experts predict will extend into 2025. “We continue to expect midcap and large-cap private equity firms to look down-market to the lower middle market for smaller platforms that they can grow over time through M&A. And we continue to expect these larger GPs to look down-market for add-on opportunities for their existing portfolios,” says HighVista Strategies’ Matthews, adding that secondaries are likely to remain active in 2025 as well. “More LPs are using the secondary market as a tool to manufacture liquidity for their portfolios. And there’s lots of dry powder out there in the secondary universe.”

But as LPs become frustrated with limited distributions and

But as LPs become frustrated with limited distributions and

the PE industry’s rising use of secondaries and continuation

funds, there will be pressure on fund managers to shift their

focus back to more traditional M&A deals in the year ahead,

according to Bryan Gadol, a partner and head of the California Corporate M&A and Private Equity practice at law firm Holland & Knight.

“Buyers are actively looking at deals, and there’s a large

pipeline that needs to move through at some point. … And the buyer’s level of optimism, coupled with the need to deploy dry powder, is strong enough that I think we will see an acceleration of things moving in that direction,” says Gadol. “Investment banks have a backlog of deals waiting to go to market. How big of a valuation gap problem will remain as we move forward remains to be determined, but that should lessen itself as interest rates, hopefully, continue to come down.”

Adds KeyBank’s Gavrity: “We haven’t necessarily seen the pull through that all of us would have expected, but I don’t know that we necessarily had the right set of ingredients yet. But we’re starting to see more of that at this point in time [late October]. We’re optimistic about the next 12 months on the M&A side.”

Though a healthy bit of skepticism remains, industry experts are confident that 2025 will finally see a major pickup in middle-market M&A activity. But only time will tell whether that actually comes to pass this time around. “Between the amount of assets that are out there and the amount of dry powder that the private equity funds are sitting on, it’s just a ticking time bomb in terms of all this coming to fruition and generating quite a bit of deal activity,” says Reed Smith’s Sheaffer.

Britt Erica Tunick is an award-winning journalist with extensive experience writing about the financial industry and alternative investing.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.