How Thematic Investing Trends Inform M&A Hiring

Headhunters, investment bankers and private equity executives discuss talent trends amid a larger focus on sector specialization

In 2023, global merger and acquisition activity dropped approximately 16% from the year prior—despite a lift in benchmarks like the S&P 500, which grew 24% during the same time period, according to a McKinsey report. And although 2024 showed some signs of improvement, the overall slowdown in deal flow led many investment banks and private equity firms to seek out under-the-radar opportunities in an effort to put capital to good use.

Known as “thematic investing,” the trend of laser-focusing on a cluster of industry specific sectors rather than relying on a broader generalist model has prompted many firms to beef up sector-focused talent in order to ferret out new leads. Some firms that historically operated within niche market spaces already are adding to their ranks to fortify their standing as attractive investment partners for prospective business owners.

Middle Market Growth spoke with a group of experts, including investment bankers, private equity investors and executive recruiters, for their input on thematic investing, staffing trends and compensation models, and a deep-dive look at what lies ahead for middle-market M&A.

Middle Market Growth: Broadly speaking, what are the advantages of a thematic investing approach to sourcing deals versus a generalist one?

Hulett: I think it’s two-fold. As a buyer in the private equity space, it’s difficult to be all things to everybody, so based on a principal’s background, experience and location, knowledge of specific industry sectors leads to more informed decision-making about market competition, the ability to scale and what levers to pull. A lot goes into these buy-and-build platforms and add-on campaigns that well-performing private equity firms know how to execute well—mainly due to their sector experience. On the flipside, in the eyes of the seller, what really matters to business owners is your pitch, because they’re invariably asking, “You may be a private equity firm, but what do you really know about my business and our industry? How can you be helpful, beyond just buying us out?”

Nemo: Our firm is as specialized as they come, with a strict focus on national security, aerospace, aircraft and industrial services. These verticals are highly technical, with complex supply chains and strict federal regulations—definitely not for the uninformed or the faint of heart. So if a founder is making this important decision to sell or to bring on a majority partner, having a team that knows their business, their market and their customers can be a real differentiator—especially since the industries we invest in have very long cycles. A 737 could be in service for 40 years, so we can’t just jump in and chase market momentum.

Goodrich: Middle-market investing has changed since the 1990s, when you didn’t have to be the smartest guy in the room to get a deal—you just needed to be the luckiest guy in the room, by virtue of having the right relationships. The advantage you had as a private equity guy in that era was your scarcity value. You were the only one doing it, so if you found a deal no one else knew about, you could buy it for less money because you weren’t running an auction process. However, that advantage has been eviscerated over the last 30 years because now there’s so much publicly available data through PitchBook, Capital IQ or just a company website, that it has virtually equalized the playing field.

The best advantage you can have today is sector-specific experience. That said, industry specialization alone is not enough. You also must understand the nuances each company brings. If you’re dealing with an industrial manufacturer with a solid management team that’s looking to grow, your strategy would be different than investing in an identical company experiencing operational problems. Both can bring in successful returns, but the first one might need help with new acquisitions, while the second one might need help with sales. You have to know which problems to solve.

MMG: From a recruitment perspective, what has thematic investing meant for hiring trends?

Lewis: There’s been an uptick in hiring at senior levels, because firms want rainmakers and people who bring in their own books of business— especially from relationships in niche sectors. And this also includes heavy team lift-outs because a firm looking to expand in a new area is more likely to have success with many senior people coming in at once. Mid-level hiring is a bit slower because mid-level operatives are more execution focused, and with deal flow slowing down over the last few years, there’s still a lot of dry powder on the private equity side.

We’re seeing a spike in senior professional hirings because so many private equity firms now have big funds, and they’re trying to diversify into alternative asset management.

Brianne Sterling

Selby Jennings

Sterling: We’re seeing a spike in senior professional hirings because so many private equity firms now have big funds, and they’re trying to diversify into alternative asset management. Plus, you’ve got investment banks—even the bulge-bracket investment banks—that are now trying to play in the mid-market space because there haven’t been many mega deals to go after. One way firms can differentiate themselves is by becoming an industry expert, where thematic investing can carry them forward through the next decade.

Gleeman: Usually, when hiring a new mid-level staffer—VP level or more senior—the private equity firms are looking for talent capable of focusing on specific areas of concentration. But when they’re hiring junior associates, they’re more flexible because they feel they can train staffers. Of course, it’s a “nice-to-have” if a candidate for an associate position has previously trained with a specific industry coverage group at an investment bank, in areas such as healthcare or industrials.

MMG: Do specialists command higher salaries than generalists?

Gleeman: I don’t think so, because compensation tends to stay within what’s considered “market range,” whether you’re a generalist or a specialist. It’s more about firm-to-firm and location-to-location. If you’re in the New York City area, either as a generalist or a specialist, you’re going to be paid a NYC rate versus a city like Cleveland, where the cost of living is lower. That’s reflected in the comp package. But associate level salaries usually start at around $200,000 at the low end and $250,000 at the higher end. Some firms in NYC may go up to $235,000 in the middle market, and then you can rely on it to increase by $50,000 per year. And normally, carry starts at the VP level, and carry is arguably the most valuable component of the compensation package in the long run, because some investments may have been originated five years ago, and a candidate may still be waiting for final returns on those deals. If you’re a private equity firm trying to attract someone senior, you need to be prepared to cover that in some way.

MMG: Have travel budgets, bonuses, PTO and other benefits constricted over the last few years?

Sterling: Due to the macroeconomic environment, firms are being very cost-conscious, which in some cases has translated into tighter budgeting around expenses, including travel budgets, budgets for conferences and even, in some cases, client engagement budgets. The only other benefit we have seen restricted has been remote working, with some firms pulling back on their remote working policies. On the other hand, there are firms that are doubling down on remote or hybrid work models in an effort to attract talent.

MMG: Finally, how will further interest rate cuts potentially impact future hiring?

Lewis: Bankers are telling me pitch activity is up, pipelines are strong, and they expect that 2025 and ’26 will bring in a lot of activity, so we anticipate hiring to pick up, especially in areas like IT services, tech-enabled services, marketing services and other highly data-driven platforms with high multiples. We’ve witnessed private equity firms building up their internal business development structures by offering carried interest and competitive packages to junior talent as a way of getting = them from larger institutions with greater brand awareness.

Sterling: Everyone anticipates 2025 is going to be massive for investment banking, as well as for private equity activity, so firms are looking at senior hires as long-term investments. They want to get talent in the door now.

Andrew Bloomenthal is an experienced journalist, editor and marketing copywriter based in Los Angeles.

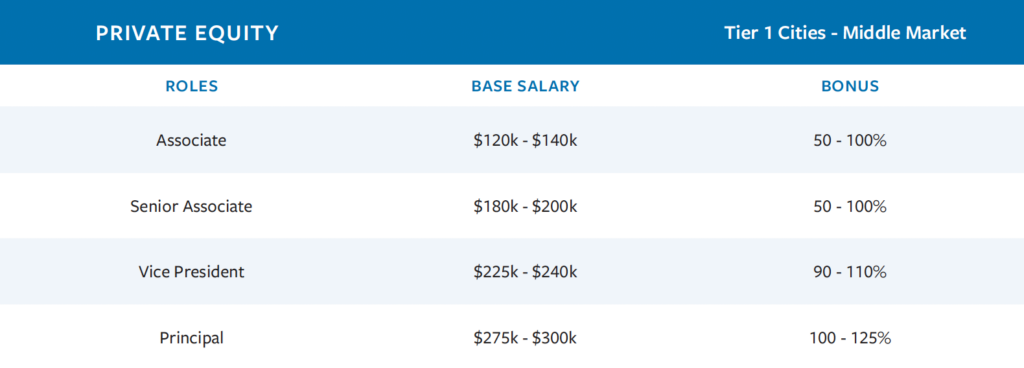

U.S. Salary Guidance, Private Markets

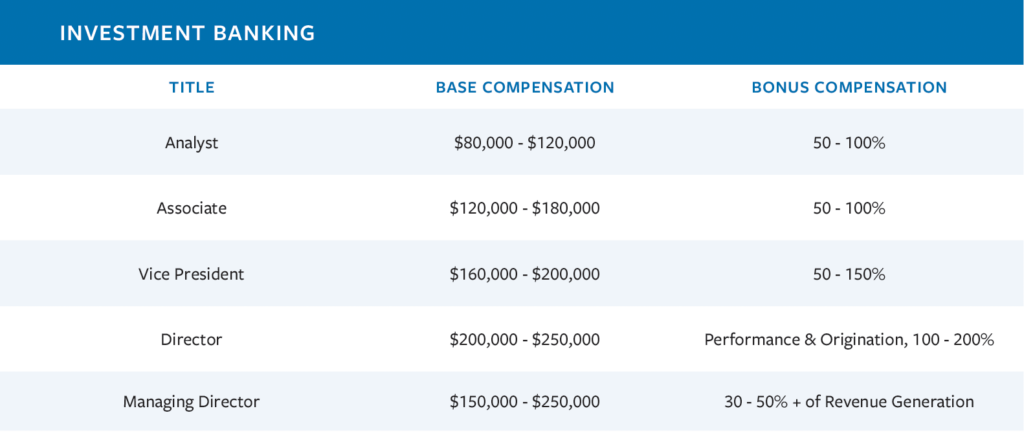

Boutique Investment Bank Compensation

Middle-Market Investment Bank Compensation

Source: Selby Jennings

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.