It Takes Two to Tango in Private Credit

A variety of banks, private debt firms and asset managers are teaming up for private credit joint ventures. Participants and advisors share some of the drivers behind these partnerships

They say that two are better than one. It seems a variety of banks, hedge funds and private credit shops have taken that message to heart by launching direct lending partnerships.

Many of these joint ventures are between a bank and a private credit firm or another type of asset manager, having formed in response to changes in the lending landscape that began after the Great Recession. Now, these partnerships are reshaping the role of banks in the middle market and expanding the options available to borrowers.

Banks have largely retrenched from middle-market lending since the passage of the Volcker Rule in 2010 as part of the Dodd-Frank Act, which limited the amount of leverage banks could provide. As a result, many bankers who worked on middle-market loans launched private debt shops, whose global assets under management have since ballooned to $1.62 trillion, according to Preqin. The collapse of Silicon Valley Bank and other institutions in 2023, as well as rising interest rates, caused commercial banks to retreat even more.

“Since the Global Financial Crisis, it became prohibitive for banks to do leveraged loans above 4x leverage, so the private credit market picked it up, and they hired the originators,” says Ken Young, partner at the law firm Dechert. “But the banks continued to have non-sponsor relationships, and those companies want leveraged loans, too.” Young estimates there are 45,000 non-sponsored middle-market companies that could benefit from these tie-ups.

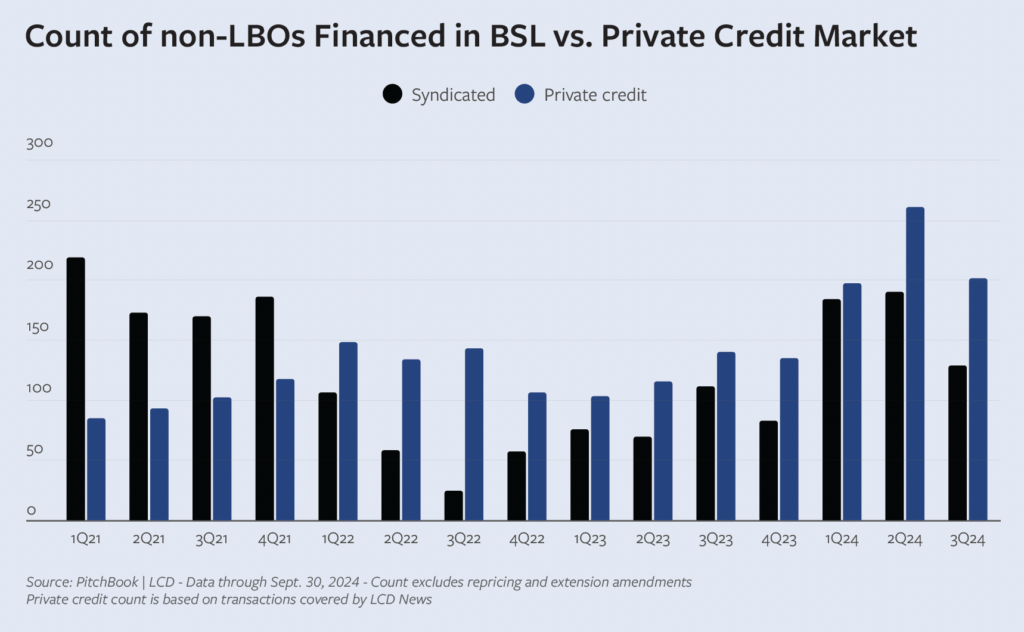

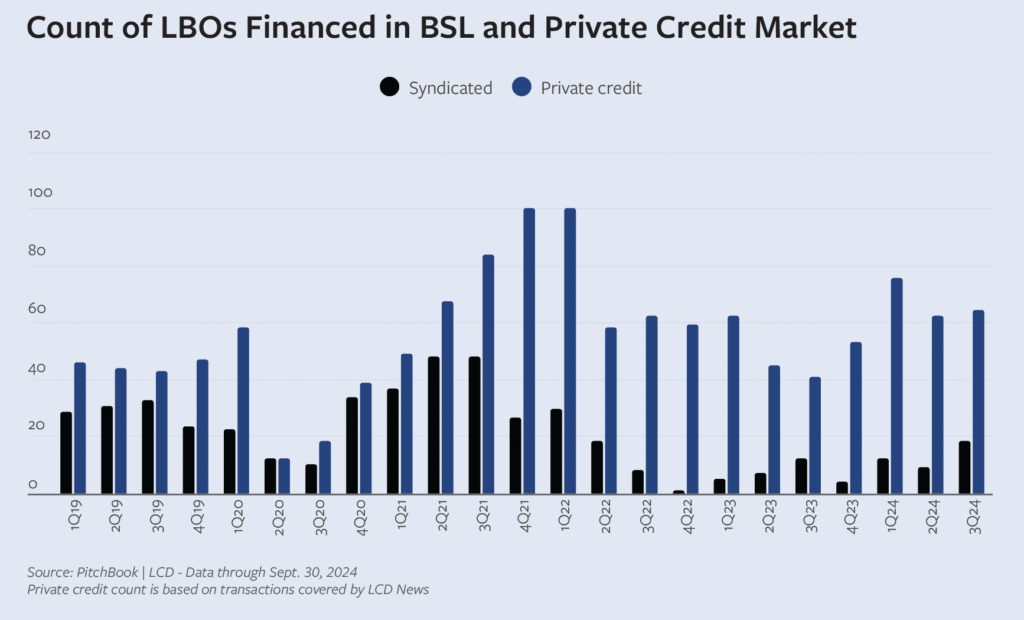

“Banks have built out large origination networks with hundreds of originators on the ground across the country, and now that private credit is increasingly being used by corporates, they are looking for ways to redeploy that origination network,” says Steve Boyko, partner and co-chair of the corporate department at Proskauer. He agrees that the non-sponsored middle-market lending area is especially attractive to investors and estimates the total addressable market for private credit is approximately $40 trillion in the United States. While private credit had surpassed the banks in leveraged buyout space a number of years ago, it began to overtake the banks in the first quarter of 2022 and has continued to gain ground since then, according to Proskauer slides presented at a recent conference.

Experts say the new partnerships are a way for banks to regain some of their market share in lending. While regulations are still stringent for banks, if they hold a small percentage of the debt financing or get involved by investing in a private fund or business development company (BDC), their participation is palatable to regulators.

The Wells Fargo and Centerbridge Tie-up

A slew of banks announced new partnerships in recent years. Wells Fargo and Centerbridge Partners paved the way in September 2023. Tie-ups followed between Lloyds Bank and Oaktree Capital Management, Citi and Apollo Global Management, PNC and TCW, and Webster Bank and Marathon Asset Management. JPMorgan is also said to be starting a partnership with institutional consulting firm Cliffwater, BDC manager FS Investments and Shenkman Capital Management, according to Bloomberg.

Experts say that the origination engines at the banks are attractive. The banks tend to have relationships with corporates, to which they provide asset-based lending, M&A & IPO advice, bond issuance and other services, and can now also step in on lending.

Some partnerships, like the one between Wells Fargo and Centerbridge, are focusing on opportunities with businesses not backed by private equity. “Our focus has been on bringing private credit to family-owned and founder-led businesses,” says David Marks, EVP with Wells Fargo Commercial Banking. “We thought our clients would really benefit from having another option and that’s why we started working with Centerbridge. Private credit really grew up around sponsors and we saw an opportunity to make private credit mainstream for Main Street.”

Centerbridge registered a BDC called Overland Advantage that is anchored with money from both firms, as well as the Abu Dhabi Investment Authority (ADIA) and the British Columbia Investment Management Corporation (BCi). “Wells Fargo sources opportunities for the BDC and Centerbridge executes the transaction,” Marks says. “It’s very common for an opportunity to have both a senior bank piece and a private credit piece of the capital structure. Centerbridge underwrites the private credit piece, we underwrite our piece. Because of our strategic relationship with Overland, together we can present a one-stop solution,” he adds.

Overland is targeting companies with $25 to $125 million and above in EBITDA. Wells Fargo’s originators are spread around the country and focused on their local markets. “This is about: how do you serve that client in Dallas or Chicago or Portland or wherever their local market is? It’s simply about bringing private credit to businesses that have never used it before,” Marks adds.

“The partnerships can tap capital for non-sponsored middle-market lending with the network that the banks have,” says Dechert’s Young. “They can connect people with capital, and firms like Centerbridge can access these companies that Wells Fargo can’t lend to.”

ADIA’s and BCi’s involvement also underscores international investors’ interest in the market. “There is a real interest by foreign capital to access the high-yielding U.S. direct lending business,” Young says.

Since the loans are usually held in the asset manager’s fund (in this case, Overland’s), these arrangements haven’t drawn regulatory opposition. “The regulators are well aware of what’s been happening with these joint ventures,” says Proskauer’s Boyko. “In fact, during the pandemic they changed the regulations to provide further guidance, so that banks could take advantage of additional exemptions from the Volcker rule.”

Other Banking Partnerships

Other banks and their partners are working on both PE-backed and non-sponsored deals. TCW announced such a partnership with PNC in May, having worked with PNC in the past: TCW provided cash-flow loans, and PNC would step in as the asset-based lender or revolver arranger.

The two firms began discussions about a partnership in 2022, says Rick Miller, chief investment officer at the TCW Private Credit Group. “There was ongoing regulatory oversight on banks, and the SVB and Republic Bank collapses created a greater sense of urgency and expectation of further regulation,” Miller adds. The partnership is focusing on companies in the $10 million to $100 million EBITDA range. “PNC has provided other services to these clients for many years and can now provide another offering in the form of cash-flow term loans,” says Miller. “The origination is primarily done through hundreds of bankers at PNC.”

The platform is targeting $2.5 billion in investor capital that will be available in the first year, which is supported by anchor investments from PNC and Japan’s Nippon Life Insurance Company, which owns a 25% stake in TCW.

In another banking tie-up, Oaktree Capital Management formed a partnership with Lloyd’s Bank in the U.K. The JV was announced in July and provides loans to U.K. middle-market sponsored borrowers. “Lloyd’s is front-facing to the client. They present the pipeline to us, and we can say yes or no,” explains Nael Khatoun, managing director at Oaktree. “We’re pari passu with them on the capital structure.”

Khatoun continues: “The core of the partnership is to increase their hold capability. It also provides certainty and speed of execution, and that’s where private credit comes in.” The group is targeting companies with £10 million to £75 million in EBITDA and takes a generalist approach, aside from avoiding GDP-dependent sectors like consumer and retail.

Different JV Flavors

Some partnerships have other goals in mind, such as gaining exposure to a new sector or strategy, or getting into private credit.

Oaktree, for example, has another state-side partnership with AVANA Companies. Glendale, Arizona-based AVANA announced its $250 million partnership with Oaktree in August. The joint venture makes loans to hotel developers around the country. AVANA CEO Sundip Patel says he has known Oaktree executives for 10 years and they had been in discussions about Oaktree wanting to tap into the commercial real estate sector. “They came out and started due diligence and gave us a term sheet for the program,” he says. The group focuses on commercial real estate development that can create more local jobs and growth, thus picking the hospitality segment that drives long-term labor, tourism and economic expansion in the surrounding area, Patel explains.

Sanat Patel, AVANA Chief Lending Officer and Sundip’s brother, adds that he’s seeing a lot of opportunities in the “smile states” of the U.S. that span the south and parts of the southeast and southwest coasts with many people and companies moving there. Hotels are also segmenting their clientele better and offering different options for high-end guests or extended-stay occupants. Some of AVANA’s recent deals included refinancings of Atlanta and Jacksonville hotels, as well as new hotel constructions in Orlando and Norco, California.

In yet another partnership, investment management firm Thornburg Investment Management and lower middle-market private equity firm Bow River Capital announced a private credit joint venture in September. “Thornburg has built a track record of excellence in public credit research and investing in public markets,” says Jesse Brownell, Thornburg’s global head of distribution. “Bow River’s 22-year track record of extensive expertise in providing flexible financing and private equity solutions made them an excellent choice [for the partnership].” The JV is targeting companies in the $5 million to $50 million EBITDA range and leverage ratios of 3.5x to 5.5x.

What’s Ahead

Experts say they expect more of these partnerships to pop up. And since some have been set up as BDCs, their filings with the SEC will eventually reveal their holdings. “There are a lot of Midwest companies or companies that have been backed by commercial banks traditionally that are going to open up to different sorts of capital and lending. It will be very interesting to see,” says Dechert’s Young. “We’re in the early innings of a creative evolution. There will be more of these tie-ups and more to the story in the coming years.”

Most of the firms participating in partnerships have experience working together informally. “Many of these deals are happening organically because people have relationships with one another, they’ve been making loans together and they have an understanding of how each party underwrites deals,” says Jennifer Crystal, partner in the Corporate Department at Proskauer. “They know the culture of the other firm, so when you think about things like workouts or restructurings, they’ve already lived through those experiences together.

“Non-traded bank debt has been around for a long time, and it’s not going away. This provides a differentiated origination engine for us,” TCW’s Miller says. “Will we win all the deals among PNC clients? No. But we would rather be here than on the outside.”

Anastasia Donde is Middle Market Growth’s senior editor.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.