The Digital Dilemma

Advertisers love to reach niche audiences, but ad placements on social media, podcasts and other online platforms have yet to deliver on their promise for middle-market companies.

Social and streaming media services would seem to be every advertiser’s dream, offering the ability to target the ideal prospective customer. But their effectiveness depends on what you sell, how you sell it and to whom.

Small and midmarket e-commerce companies in specific niches, for example, are finding certain channels ideal. Larger companies that rely mainly on brick-and-mortar retail stores, not so much.

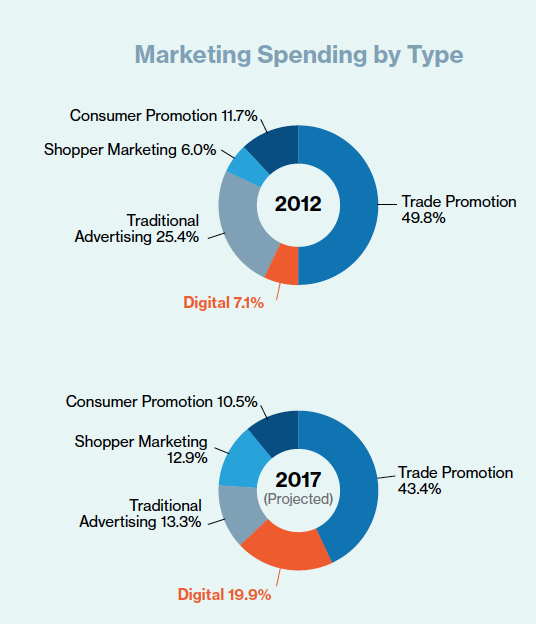

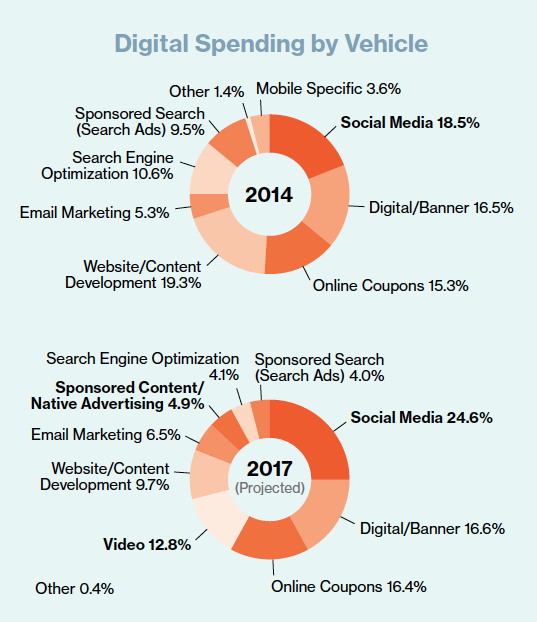

Spending on digital advertising is growing quickly. Internet advertising revenue in the United States totaled $72.5 billion in 2016, up nearly 22 percent over 2015, according to a report last year by PwC and the Interactive Advertising Bureau. A separate 2017 survey by Cadent Consulting Group, which works with retail and consumer packaged goods companies, reports that digital ads make up nearly 20 percent of marketing spending, nearly triple that of five years ago.

Companies love digital advertising’s ability to reach specific audiences. On Facebook, for example, an advertiser can target women between the ages of 30 and 40 who live in a particular zip code and buy organic produce.

“With all of digital’s promise, and despite Facebook and Google telling you they know beyond a shadow of a doubt what makes people purchase, they really don’t.”

KEN HARRIS

Managing Partner, Cadent Consulting Group LLC

But even with online advertising’s precision, the medium has limitations, and marketers are unsure of the ads’ return on investment. In the Cadent survey, digital received the lowest effectiveness rating by retailers and the lowest awareness and impact ratings by shoppers.

“With all of digital’s promise, and despite Facebook and Google telling you they know beyond a shadow of a doubt what makes people purchase, they really don’t,” says Ken Harris, managing partner at Cadent.

Meanwhile, the hype around digital advertising has caused spending to outpace tangible results.

“A lot of people sank a lot of money into that industry before really understanding whether it was having an effect,” says Dave Van Dyke, president of media researcher Bridge Ratings. “Some of it does work, but a lot of advertisers are not seeing an ROI.”

Door to Digital Door

Door to Door Organics, an online subscription service for organic produce, spends about 90 percent of its advertising budget on digital, says Andrea Daily, vice president of marketing for the privately held company, based in Louisville, Colorado. Most of that spending is allocated to social media, primarily Facebook and Instagram. Those platforms allow the company to zero in on demographic and interest-based targets, such as 35-year-olds with a penchant for organic food living in specific cities.

With Facebook, for example, Door to Door can pull data on its existing customers who generate the most sales and upload that information to Facebook’s advertising platform. Facebook’s algorithm then identifies a group of its users that matches those characteristics and displays Door to Door’s ads on their news feeds.

The company has had success on the social media platform by publishing content, like recipes or useful articles on topics like how to can fresh fruit, Daily says, but Facebook is not where it has seen the highest ROI.

The company gets the biggest bang for its buck by paying for clicks on results from search engines, specifically Google. Unlike Facebook users who are served an ad while scrolling past their friends’ wedding and baby photos, consumers who type “organics” or other keywords into a search bar are often ready to buy.

Meanwhile, good old-fashioned direct mail— which accounts for most of the 10 percent of dollars Door to Door allocates to traditional advertising—is similarly targeted, Daily notes. But it’s less flexible and requires upfront spending before producing results. With social media, companies can tweak or even turn off an ad if it’s not performing.

“That’s what’s been the most fun and rewarding part of digital advertising,” Daily says. “We are constantly testing out new ideas and seeing what works and what doesn’t.”

Learn more about Madison Reed in a cover profile of the company featured in the July/August issue of MMG.

Madison Reed, a San Francisco-based e-commerce company that sells natural hair coloring free from harsh chemicals for in-home use, spends 85 percent of its marketing budget on digital, says Heidi Dorosin, the company’s chief marketing officer. It favors Facebook because that’s the platform where the company’s demographic—older women with graying hair—congregates.

The company can easily measure performance because all its ads have a “buy now” button. If a user clicks one, Madison Reed knows the ad is effective. Even if the ad is designed to tell a story rather than directly appeal to the consumer to buy, it will include a button to “find your perfect shade,” Dorosin adds.

“That’s how we invite them to our website. So we can measure the effectiveness of every story that we tell,” she adds.

Casting a Targeted Net

MeUndies, a Los Angeles-based online seller of “softer than soft” basics such as panties and briefs, advertises on podcasts with “influencers that people trust,” Gregg Fass, the company’s marketing officer, told an audience at the ACG LA Business Conference in September. The company ran a “Celebrate Yourself” campaign during National LGBT Pride Month in June that included underwear in a rainbow polka-dot print. Such campaigns help engage consumers “in a product category that has been very boring,” he said during a panel session at the conference.

If You Sell Online, You Better Keep It Real

Online retailers are developing socially responsible brands with clear positions on issues like poverty and LGBTQ rights to bolster consumer engagement.

Read more about MeUndies and the insights into online advertising offered by panelists at the ACG LA Business Conference.

Like MeUndies, Door to Door, the produce seller, has explored podcasts. Daily says she wants to try them but has yet to find a podcasting partner that can target customers in the particular way the company is looking for.

“The challenge for us is that we have a very specific delivery footprint,” she says. “So everything we do is very geo-targeted in terms of zip codes.”

Door to Door has the same issue with online streaming music services like Pandora and has found traditional radio to be a better fit. NPR, for example, offers the highly educated audience that Door to Door is targeting. The company has also developed partnerships with regional DJs who can “authentically speak to their experience with (our) brand,” Daily says.

Large Companies Are Less ‘Social’

While small and midsize online companies continue to rely on digital advertising, some large companies have stepped back from it, in part because the ROI is difficult to quantify. Last year, the chief brand officer of household products giant Procter & Gamble, Marc Pritchard, took the industry to task for its lack of standards that could help companies better measure online advertising’s effectiveness.

Door to Door’s Daily, who previously worked for consumer packaged goods companies, understands the frustration. But large CPG companies have a different business model that makes digital advertising less effective.

“It’s difficult to judge the success of your efforts because all your transactions are happening in a store offline, and (you’re not) able to identify that a particular ad resulted in these sales,” she explains. With an e-commerce model, companies can see the transactions in real time and track what prompted them, such as an ad or coupon offer.

Nevertheless, Daily agrees that the analytics for ad effectiveness are not where they should be. “We’ve found certain things to be okay, but some of the visibility is shielded from us as a client,” she says, often because social media companies jealously guard their data and algorithms.

Digging Into Digital

Even with its shortcomings, advertising spending will inexorably shift more and more to digital, says Tom Webster, vice president of strategy at Edison Research, which studies media markets. He notes that consumers are increasingly turning away from traditional media and subscribing to services like Netflix and Pandora so they can control how, when and where they consume content. Those services offer very little, if any, advertising, he notes.

“The addressable audience for advertising is shrinking and shrinking,” he says. Certain types of people in specific regions may be reachable only on digital channels.

What’s more, even the most effective digital channels will continue to shift as new platforms are launched and audiences change their preferences. As an advertiser’s target market matures, it may need to shift its ads to new channels. Dorosin of Madison Reed, for example, is increasingly interested in Instagram, which millennials prefer over Facebook, as a way to put her product in front of a potential new customer base.

“The oldest millennial is now 37 years old, which is when gray hair starts,” she says.

Update: Since this story was written, Door to Door Organics announced that it has ceased operations. On its website, the company cited the “timing of recent events in our industry and the impact that had on our funding prospects” as a factor in its decision to shutter.

Tam Harbert is a freelance journalist in the Washington, D.C. area who frequently covers technology.